Shaw 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

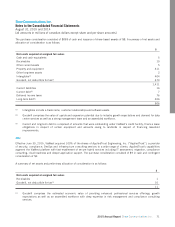

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

The Company’s joint operations include a 33.33% interest in the Burrard Landing Lot 2 Holdings Partnership (the

“Partnership”) and until January 1, 2014, a 50% interest in Historia and Series+ s.e.nc (“Historia and Series+”).

The Partnership owns and leases commercial space in Shaw Tower in Vancouver, BC, which is the Company’s headquarters for

its lower mainland operations. In classifying its 33.33% interest in the Partnership as a joint operation, the Company

considered the terms and conditions of the partnership agreement and other facts and circumstances including the primary

purpose of Shaw Tower which is to provide lease space to the partners.

Historia and Series+ are two Canadian French-language specialty television channels. The Company classified its 50% interest

as a joint operation after considering the terms and conditions of the partnership agreement and other facts and circumstances

including the significant obligations that arise with respect to the CRTC broadcasting licenses which are required to operate the

channels and which are held at the partner level.

Investments in associates and joint ventures

Associates are entities over which the Company has significant influence. Significant influence is the power to participate in the

operating and financial policies of the investee, but is not control or joint control.

A joint venture is a type of joint arrangement whereby the parties that have joint control of the arrangement have rights to the

net assets of the joint arrangement. Joint control is the contractually agreed sharing of control of an arrangement, which exists

only when decisions about the relevant activities require unanimous consent of the parties sharing control.

Investments in associates and joint ventures are accounted for using the equity method. Investments of this nature are recorded

at original cost and adjusted periodically to recognize the Company’s proportionate share of the associate’s or joint venture’s net

income/loss and other comprehensive income/loss after the date of investment, additional contributions made and dividends

received.

The Company has classified its 50% interest in Shomi Partnership (“shomi”) after considering the terms and conditions of the

partnership agreement and other facts and circumstances including business plans to make the service available to subscribers

of other distributors and as an over-the-top service for purchase by any subscriber.

Revenue and expenses

The Company has multiple deliverable arrangements comprised of upfront fees (subscriber connection, installation and

customer premise equipment revenue) and related subscription and service revenue. Upfront fees charged to customers do not

constitute separate units of accounting, therefore these revenue streams are assessed as an integrated package.

(i) Revenue

Revenue from cable, Internet, Digital Phone and DTH customers includes subscriber revenue earned as services are provided.

Satellite distribution services and telecommunications service revenue is recognized in the period in which the services are

rendered to customers. Affiliate subscriber revenue is recognized monthly based on subscriber levels. Advertising revenues are

recognized in the period in which the advertisements are broadcast and recorded net of agency commissions as these amounts

are paid directly to the agency or advertiser. When a sales arrangement includes multiple advertising spots, the proceeds are

allocated to individual advertising spots under the arrangement based on relative fair values. Revenue from data centre

customers includes colocation and other services revenue, including managed infrastructure revenue. Colocation revenue is

recognized on a straight-line line basis over the term of the customer contract. Other services revenue, including managed

infrastructure revenue, is recognized as the services are provided.

Subscriber connection fees received from customers are deferred and recognized as revenue on a straight-line basis over three

years. Direct and incremental initial selling, administrative and connection costs related to subscriber acquisitions are

recognized as an operating expense as incurred. The costs of physically connecting a new home are capitalized as part of the

distribution system and costs of disconnections are expensed as incurred.

2015 Annual Report Shaw Communications Inc. 61