Shaw 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

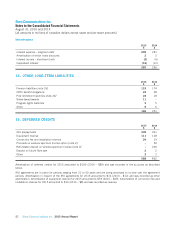

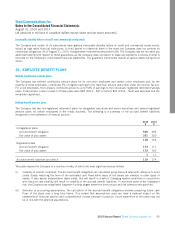

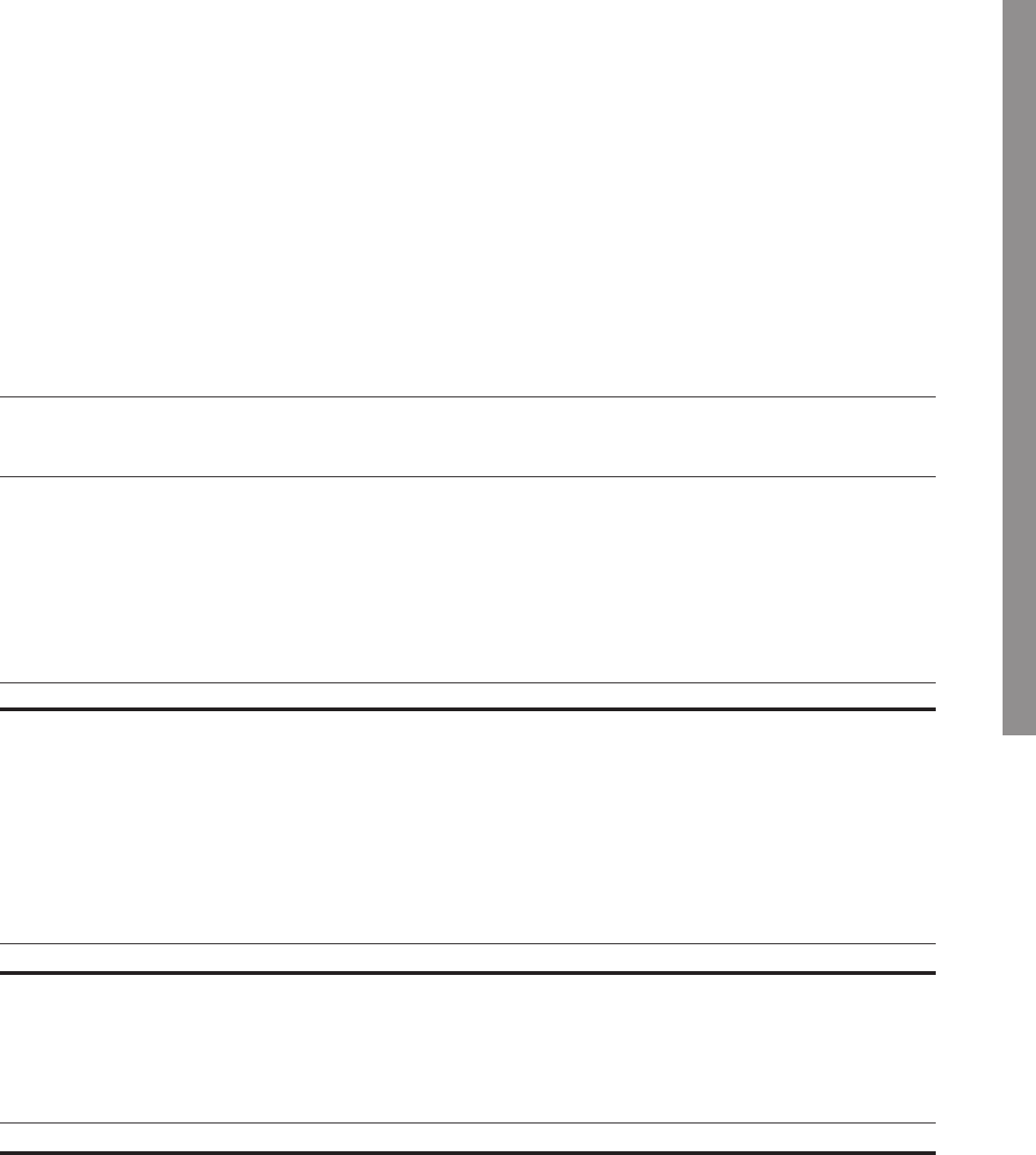

Significant changes recognized to deferred income tax assets (liabilities) are as follows:

Property, plant

and equipment

and software

assets

$

Broadcast

rights,

licenses,

customer

relationships,

trademark

and brands

$

Partnership

income

$

Non-capital

loss carry-

forwards

$

Accrued

charges

$

Foreign

exchange on

long-term debt

and fair value

of derivative

instruments

$

Total

$

Balance at September 1, 2013 (140) (813) (267) 6 73 (1) (1,142)

Recognized in statement of income (37) (5) 107 – (19) – 46

Recognized in other comprehensive income – – – – 16 1 17

Balance at August 31, 2014 (177) (818) (160) 6 70 – (1,079)

Recognized in statement of income (25) (21) 107 34 (33) – 62

Recognized on ViaWest business

acquisition (9) (142) – 46 29 – (76)

Recognized in other comprehensive

income:

Foreign currency translation

adjustments – (29) – 12 1 – (16)

Actuarial gains/losses – – – – (12) – (12)

Balance at August 31, 2015 (211) (1,010) (53) 98 55 – (1,121)

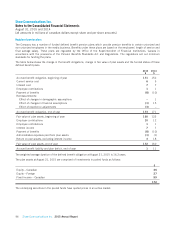

The Company has capital loss carryforwards of approximately $61 for which no deferred income tax asset has been recognized

in the accounts. These capital losses can be carried forward indefinitely.

The Company has taxable temporary differences associated with its investment in its subsidiaries. No deferred tax liabilities

have been provided with respect to such temporary differences as the Company is able to control the timing of the reversal and

such reversal is not probable in the foreseeable future.

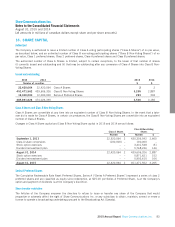

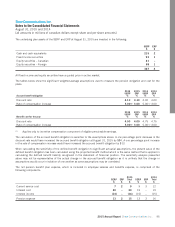

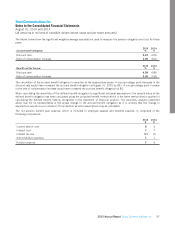

The income tax expense differs from the amount computed by applying the statutory rates to income before income taxes for

the following reasons:

2015

$

2014

$

Current statutory income tax rate 25.7% 26.0%

Income tax expense at current statutory rates 302 311

Net increase (decrease) in taxes resulting from:

Non-taxable portion of capital gains (24) (8)

Effect of tax rate changes 34 –

Recognition of previously unrecognized tax losses –(1)

Other (18) 6

Income tax expense 294 308

Due to foreign operations, the statutory income tax rate for the Company decreased from 26.0% in 2014 to 25.7% in 2015.

2015 Annual Report Shaw Communications Inc. 89