Shaw 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

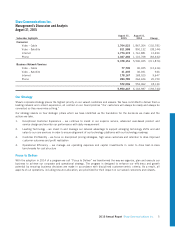

Specialty Channels

Shaw Media operates 19 of Canada’s most popular

specialty channels, including HGTV Canada, Food

Network Canada, Showcase, HISTORY, Slice and

National Geographic.

All of our specialty channels are wholly-owned by Shaw with the exception of channels for which we have partnered with global

leaders: Food Network Canada, HGTV Canada, DIY Canada (each of the foregoing with Scripps Networks), National Geographic

Canada, National Geographic Canada Wild and BBC

Canada. Our equity interests in these channels ranges

between 50% and 71%, with voting control of 80% or

more.

Over-the-top

To meet the changing needs of our conventional and specialty viewing audiences, Media rolled out Global Go and HISTORY Go

apps in 2014. These apps allow viewers to watch live TV, full episodes of select shows, clips and video exclusives on popular

mobile devices, including WiFi enabled devices.

In November 2014, in partnership with Rogers Communications we launched shomi on a test basis

to Shaw and Rogers customers. In August 2015, the service was made available to all Canadians.

With a current library of approximately 1,200 films and 15,000 individual episodes in categories

curated by experts, shomi offers its subscribers some of the best entertainment available – whenever and wherever they want.

shomi may be accessed over-the-top through the service’s website and the shomi app and on television through the on-demand

libraries of participating television providers.

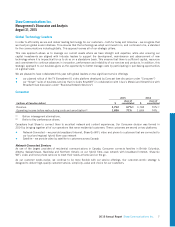

Advertising

Our Media team is exploring a number of next generation advertising solutions that combine the intelligence of data with the

power of television to maintain and grow our advertising business.

We are part of an industry working group that is looking at the development of a common video terminal based measurement

system. We are also exploring new ways for advertisers to focus on optimal advertising placement on our programming by

identifying generic audience profiles and aggregate lifestyle demographics that can be used to identify relevant “audiences”.

This allows advertisers to make decisions based on identified demographics to purchase “audiences” rather than shows and

time slots. All data collection, analysis and use is designed for compliance with applicable privacy protection laws.

The Media team is also continuing to create opportunities for branded content and product integrations within our shows and

brands. As one of the leading lifestyle content providers in Canada, we have a strong slate of context-relevant, original

productions into which advertisers can integrate their products. This type of integration yields positive results for the

advertisers, generating a positive impact on brand perception, likelihood to purchase and consumer trust in the product.

Through these next generation advertising solutions Shaw is working to ensure that our advertising opportunities evolve with the

expectations of our advertising clients to position our Media team as the most innovative media partner for advertisers in our

space.

We are also building revenues from our increasingly popular digital platforms along with further syndication opportunities

around our strong content.

Through these initiatives and advances in the way we create content, produce and deliver news and develop business, we have

moved Media beyond the traditional broadcast model to become a driven media company.

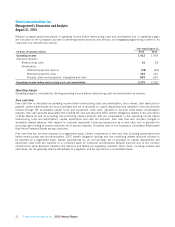

Seasonality

The Media financial results are subject to fluctuations throughout the year due to, among other things, seasonal advertising and

viewing patterns. In general, advertising revenues are higher during the fall, the first quarter, and lower during the summer

months, the fourth quarter, whereas expenses are incurred more evenly throughout the year. The specialty services depend on a

small number of broadcast distribution undertakings (“BDUs”) for distribution of their services.

14 Shaw Communications Inc. 2015 Annual Report