Shaw 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

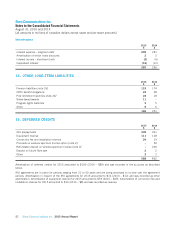

17. SHARE-BASED COMPENSATION AND AWARDS

Stock option plan

Under a stock option plan, directors, officers, employees and consultants of the Company are eligible to receive stock options to

acquire Class B Non-Voting Shares with terms not to exceed ten years from the date of grant. Options granted up to August 31,

2015 vest evenly on the anniversary dates from the original grant date at either 25% per year over four years or 20% per year

over five years. The options must be issued at not less than the fair market value of the Class B Non-Voting Shares at the date

of grant. The maximum number of Class B Non-Voting Shares issuable under the plan may not exceed 52,000,000. As at

August 31, 2015, 30,632,531 Class B Non-Voting Shares have been issued under the plan.

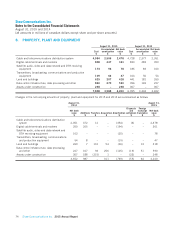

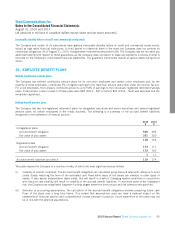

The changes in options are as follows:

2015 2014

Number

Weighted

average

exercise

price

$ Number

Weighted

average

exercise

price

$

Outstanding, beginning of year 16,477,563 22.34 19,555,441 21.71

Granted 2,911,250 28.29 1,633,000 25.76

Forfeited (978,528) 25.12 (1,279,330) 22.12

Exercised(1) (5,871,621) 21.94 (3,431,548) 20.46

Outstanding, end of year 12,538,664 23.70 16,477,563 22.34

(1) The weighted average Class B Non-Voting Share price for the options exercised was $29.28.

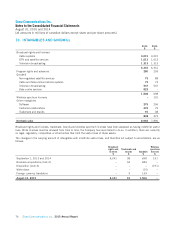

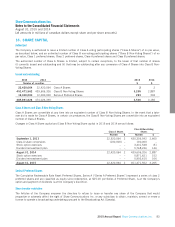

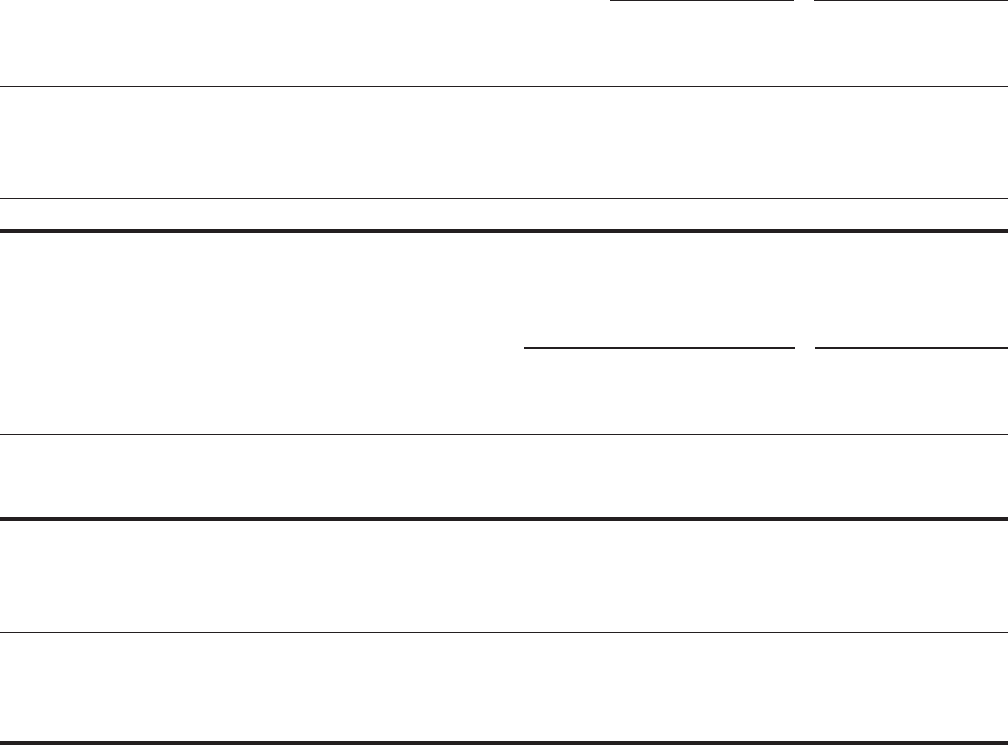

The following table summarizes information about the options outstanding at August 31, 2015:

Options outstanding Options exerciseable

Range of prices

Number

outstanding

Weighted

average

remaining

contractual

life

Weighted

average

exercise

price

Number

exercisable

Weighted

average

exercise

price

$16.30 – $19.99 2,696,237 3.89 19.15 2,615,737 19.14

$20.00 – $24.99 6,020,777 4.32 23.25 4,611,027 23.30

$25.00 – $30.87 3,821,650 8.31 27.61 616,650 26.26

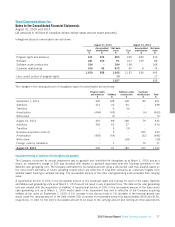

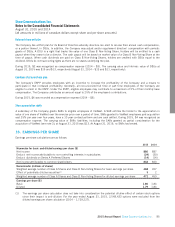

The weighted average estimated fair value at the date of the grant for common share options granted for the year ended

August 31, 2015 was $2.85 (2014 – $2.61) per option. The fair value of each option granted was estimated on the date of the

grant using the Black-Scholes option pricing model with the following weighted-average assumptions:

2015 2014

Dividend yield 3.96% 4.18%

Risk-free interest rate 1.41% 1.61%

Expected life of options 6 years 5 years

Expected volatility factor of the future expected market price of Class B Non-Voting Shares 19.1% 19.6%

Expected volatility has been estimated based on the historical share price volatility of the Company’s Class B Non-Voting

Shares.

84 Shaw Communications Inc. 2015 Annual Report