Shaw 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

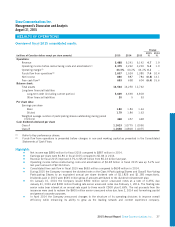

Business infrastructure services

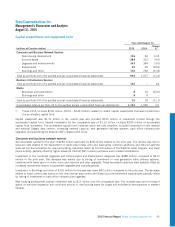

Capital investment of $152 million for the year is primarily related to growth related capital investment in core infrastructure

and equipment to deploy customer solutions. The amounts include $39 million related to investment in Canada.

ViaWest completed construction of its new facility in Hillsboro, Oregon in fiscal 2015 and completed construction on the new

flagship facility in Calgary in the fall of 2015. Each of these facilities will offer a comprehensive suite of infrastructure services,

including colocation, cloud and other managed services.

Media

Capital investment for the year was $16 million compared to $18 million in the prior year as work continued on various projects

including upgrading production equipment, infrastructure and facility investments.

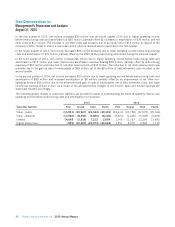

FINANCIAL POSITION

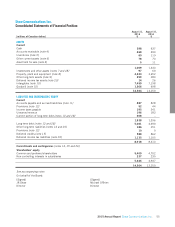

Total assets were $14.6 billion at August 31, 2015 compared to $13.2 billion at August 31, 2014. Following is a discussion of

significant changes in the consolidated statement of financial position since August 31, 2014. The impact of the acquisition of

ViaWest includes the ongoing effects of foreign exchange differences arising on translation of those U.S. operations subsequent

to acquisition.

Current assets decreased $324 million due to decreases in cash of $239 million, inventories of $59 million and accounts

receivable of $25 million. Cash decreased as the cash outlay for investing activities, including the acquisition of ViaWest,

exceeded the funds provided by financing and operating activities. Accounts receivable decreased due to lower subscriber and

advertising receivables as a result of timing of collections, partially offset by the effect of the acquisition of ViaWest while

inventories were lower due to timing of equipment purchases and supply chain efficiencies.

Investments and other assets increased $37 million mainly due to the Company’s interest in shomi.

Property, plant and equipment increased $568 million due to the acquisition of ViaWest as well as current year capital

investment in excess of amortization. Other long-term assets decreased $24 million due to lower deferred equipment costs.

Intangibles and goodwill increased $1.1 billion due to the acquisition of ViaWest, partially offset by the sale of the wireless

spectrum licenses.

Current liabilities increased $542 million due to increases in accounts payable and accrued liabilities of $59 million and

current portion of long-term debt of $608 million, partially offset by a decline in income taxes payable of $146 million.

Accounts payable and accrued liabilities increased due to timing of payment and fluctuations in various payables including

capital expenditures as well as the effect of the ViaWest acquisition. The current portion of long-term debt includes the $300

million variable rate senior notes which are due in February 2016, the 6.15% senior notes due in May 2016 and amounts in

respect of ViaWest’s debt. Income taxes payable decreased due to tax instalment payments, partially offset by the current year

provision.

Long-term debt increased $371 million due to ViaWest’s debt and borrowings under the Company’s credit facility of US$330

million used to partially fund the acquisition of ViaWest, partially offset by the reclassification of the aforementioned senior

notes to current liabilities.

Other long-term liabilities decreased $65 million due to contributions to employee benefit plans, partially offset by current year

pension expense, and a decrease in CRTC benefit obligations.

Deferred credits decreased $274 million due to completion of the sale of the spectrum licenses as the Company had previously

received $50 million in respect of the purchase price of the option to acquire wireless spectrum licenses and a $200 million

deposit in respect of the option exercise price during fiscal 2013.

Deferred income tax liabilities, net of deferred income tax assets, increased $42 million due to amounts arising on the

acquisition of ViaWest, partially offset by the current year income tax recovery.

Shareholders’ equity increased $709 million primarily due to increases in share capital of $318 million and retained earnings

of $294 million and a decrease in accumulated other comprehensive loss of $114 million, partially offset by a decrease of $19

46 Shaw Communications Inc. 2015 Annual Report