Shaw 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Management’s Discussion and Analysis

August 31, 2015

Relative increases period-over-period in operating income before restructuring costs and amortization and in operating margin

are indicative of the Company’s success in delivering valued products and services, and engaging programming content to its

customers in a cost-effective manner.

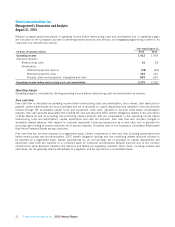

Year ended August 31,

(millions of Canadian dollars) 2015 2014

Operating income 1,432 1,439

Add back (deduct):

Restructuring costs 52 58

Amortization:

Deferred equipment revenue (78) (69)

Deferred equipment costs 164 142

Property, plant and equipment, intangibles and other 809 692

Operating income before restructuring costs and amortization 2,379 2,262

Operating margin

Operating margin is calculated by dividing operating income before restructuring costs and amortization by revenue.

Free cash flow

Free cash flow is calculated as operating income before restructuring costs and amortization, less interest, cash taxes paid or

payable, capital expenditures (on an accrual basis and net of proceeds on capital dispositions and adjusted to exclude amounts

funded through the accelerated capital fund) and equipment costs (net), adjusted to exclude share-based compensation

expense, less cash amounts associated with funding the new and assumed CRTC benefit obligations related to the acquisition

of Shaw Media as well as excluding non-controlling interest amounts that are consolidated in the operating income before

restructuring costs and amortization, capital expenditure and cash tax amounts. Free cash flow also includes changes in

receivable related balances with respect to customer equipment financing transactions as a cash item, and is adjusted for

recurring cash funding of pension amounts net of pension expense. Dividends paid on the Company’s Cumulative Redeemable

Rate Reset Preferred Shares are also deducted.

Free cash flow has not been reported on a segmented basis. Certain components of free cash flow including operating income

before restructuring costs and amortization, CRTC benefit obligation funding, and non-controlling interest amounts continue to

be reported on a segmented basis. Capital expenditures (on an accrual basis net of proceeds on capital dispositions) and

equipment costs (net) are reported on a combined basis for Consumer and Business Network Services due to the common

infrastructure while Business Infrastructure Services and Media are separately reported. Other items, including interest and

cash taxes, are not generally directly attributable to a segment, and are reported on a consolidated basis.

22 Shaw Communications Inc. 2015 Annual Report