Quest Diagnostics 2003 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

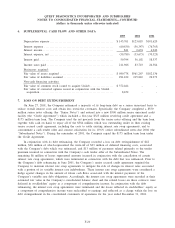

15. COMMITMENTS AND CONTINGENCIES

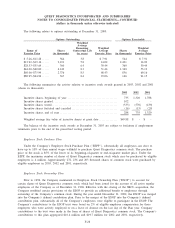

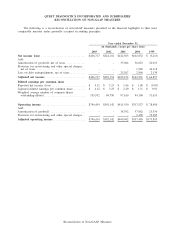

Minimum rental commitments under noncancelable operating leases, primarily real estate, in effect at

December 31, 2003 are as follows:

Year ending December 31,

2004 .................................................................................. $122,596

2005 .................................................................................. 96,987

2006 .................................................................................. 73,249

2007 .................................................................................. 56,690

2008 .................................................................................. 44,109

2009 and thereafter .................................................................... 136,150

Minimum lease payments ............................................................... 529,781

Noncancelable sub-lease income......................................................... (763)

Net minimum lease payments......................................................... $529,018

Operating lease rental expense for 2003, 2002 and 2001 aggregated $121 million, $97 million and $83

million, respectively.

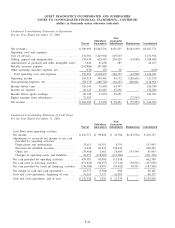

The Company has certain noncancelable commitments to purchase products or services from various

suppliers, mainly for telecommunications and standing orders to purchase reagents and other laboratory supplies.

At December 31, 2003, the approximate total future purchase commitments are $75 million, of which $39

million are expected to be incurred in 2004.

In support of its risk management program, the Company has standby letters of credit issued under its

letter of credit lines and unsecured revolving credit facility to ensure its performance or payment to third

parties, which amounted to $57 million at December 31, 2003, of which $44 million was issued against the

letter of credit lines with the remaining $13 million issued against our $325 million unsecured revolving credit

facility. The letters of credit, which are renewed annually, primarily represent collateral for current and future

automobile liability and workers’ compensation loss payments. During January 2004, $13 million in letters of

credit issued against the $325 million unsecured revolving credit facility were cancelled and $17 million of

letters of credit were issued under the letter of credit lines.

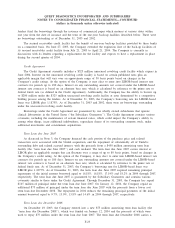

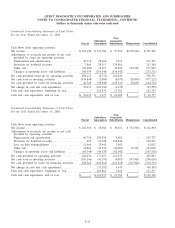

The Company has entered into several settlement agreements with various government and private payers

during recent years relating to industry-wide billing and marketing practices that had been substantially

discontinued by the mid-1990s. In addition, the Company is aware of several pending lawsuits filed under the

qui tam provisions of the civil False Claims Act and has received notices of private claims relating to billing

issues similar to those that were the subject of prior settlements with various government payers. Some of the

proceedings against the Company involve claims that are substantial in amount. Some of the cases involve the

operations of Unilab prior to the closing of the Unilab acquisition.

Although management believes that established reserves for both indemnified and non-indemnified claims

are sufficient, it is possible that additional information (such as the indication by the government of criminal

activity, additional tests being questioned or other changes in the government’s or private claimants’ theories of

wrongdoing) may become available which may cause the final resolution of these matters to exceed established

reserves by an amount which could be material to the Company’s results of operations and cash flows in the

period in which such claims are settled. The Company does not believe that these issues will have a material

adverse effect on its overall financial condition.

In addition to the billing-related settlement reserves discussed above, the Company is involved in various

legal proceedings arising in the ordinary course of business. Some of the proceedings against the Company

involve claims that are substantial in amount. Although management cannot predict the outcome of such

proceedings or any claims made against the Company, management does not anticipate that the ultimate

outcome of the various proceedings or claims will have a material adverse effect on our financial position but

may be material to the Company’s results of operations and cash flows in the period in which such proceedings

or claims are resolved.

F-30