Quest Diagnostics 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

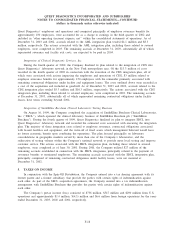

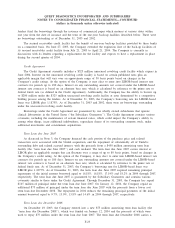

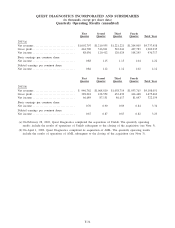

Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) for 2003, 2002 and 2001 were as

follows:

Foreign Accumulated

Currency Market Other

Translation Value Comprehensive

Adjustment Adjustment Income (Loss)

Balance, December 31, 2000 ............................. $(3,208) $(2,250) $(5,458)

Translation adjustment ................................... (1,178) - (1,178)

Market value adjustment, net of tax expense of $2,093 .... - 3,166 3,166

Balance, December 31, 2001 ............................. (4,386) 916 (3,470)

Translation adjustment ................................... 1,906 - 1,906

Market value adjustment, net of tax benefit of $2,627 ..... - (3,960) (3,960)

Balance, December 31, 2002 ............................. (2,480) (3,044) (5,524)

Translation adjustment ................................... 2,169 - 2,169

Market value adjustment, net of tax expense of $6,201 .... - 9,302 9,302

Balance, December 31, 2003 ............................. $ (311) $ 6,258 $ 5,947

The market value adjustments for 2003, 2002 and 2001 represented unrealized holding gains (losses), net of

taxes.

For the year ended December 31, 2001, other comprehensive income included the cumulative effect of the

change in accounting for derivative financial instruments upon adoption of SFAS 133, as amended, which

reduced comprehensive income by approximately $1 million. In addition, in conjunction with the Company’s

debt refinancing, the interest rate swap agreements were terminated and the losses reflected in stockholders’

equity as a component of comprehensive income were reclassified to earnings and reflected within the loss on

debt extinguishment in the consolidated statements of operations for the year ended December 31, 2001 (see

Note 7).

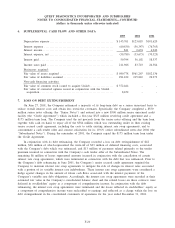

Dividend Policy

Through October 20, 2003, the Company never declared or paid cash dividends on its common stock. On

October 21, 2003, the Company’s Board of Directors declared a quarterly cash dividend of $0.15 per common

share. The initial $15.4 million quarterly dividend was paid on January 23, 2004 to shareholders of record on

January 8, 2004.

Share Repurchase Plan

In May 2003, the Company’s Board of Directors authorized a share repurchase program, which permits the

Company to purchase up to $300 million of its common stock. In October 2003, the Board of Directors

increased the share repurchase authorization by an additional $300 million. Through December 31, 2003, the

Company has repurchased 4.0 million shares of its common stock at an average price of $64.54 per share for a

total of $258 million under the program.

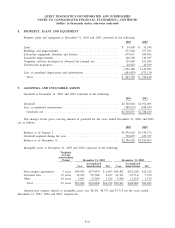

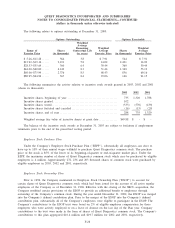

13. STOCK OWNERSHIP AND COMPENSATION PLANS

Employee and Non-employee Directors Stock Ownership Programs

In 1999, the Company established the 1999 Employee Equity Participation Program (the “1999 EEPP’’) to

replace the Company’s prior plan established in 1996 (the “1996 EEPP’’). The 1999 EEPP provides for three

types of awards: (a) stock options, (b) stock appreciation rights and (c) incentive stock awards. The 1999 EEPP

provides for the grant to eligible employees of either non-qualified or incentive stock options, or both, to

purchase shares of Quest Diagnostics common stock at no less than the fair market value on the date of grant.

The stock options are subject to forfeiture if employment terminates prior to the end of the prescribed vesting

F-26