Quest Diagnostics 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

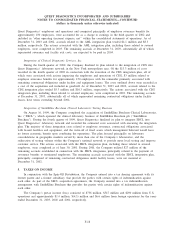

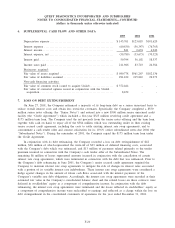

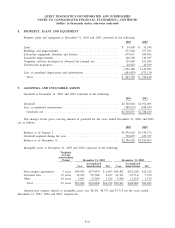

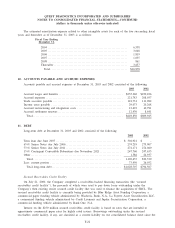

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

Senior Subordinated Notes due 2009 and $23 million of related tender premium and associated tender offer

costs.

The Company financed the cash portion of the purchase price and related transaction costs, and the

repayment of substantially all of Unilab’s outstanding debt and related accrued interest, with the proceeds from

a new $450 million amortizing term loan due 2007 (see Note 11) and cash on-hand.

As part of the Unilab acquisition, Quest Diagnostics acquired all of Unilab’s operations, including its

primary testing facilities in Los Angeles, San Jose and Sacramento, California, and approximately 365 patient

service centers and 35 rapid response laboratories and approximately 4,100 employees. The Company expects to

realize significant benefits from the acquisition of Unilab. As the leading commercial clinical laboratory in

California, the acquisition of Unilab positions the Company to capitalize on its leading position within the

laboratory testing industry, further enhancing its national network and access to its comprehensive range of

services. Customers and patients are expected to benefit from the acquisition by having greater access to

diagnostic testing services through the Company’s expanded network of patient service centers. In addition,

customers will be provided with state-of-the-art electronic connectivity services, innovative technologies and an

expanded esoteric testing menu from the Company’s Nichols Institute based in San Juan Capistrano, California.

In connection with the acquisition of Unilab, as part of a settlement agreement with the United States

Federal Trade Commission, the Company entered into an agreement to sell to Laboratory Corporation of

America Holdings, Inc., (“LabCorp’’), certain assets in northern California for $4.5 million, including the

assignment of agreements with four independent physician associations (“IPA’’) and leases for 46 patient service

centers (five of which also serve as rapid response laboratories) (the “Divestiture’’). Approximately $27 million

in annual net revenues were generated by capitated fees under the IPA contracts and associated fee-for-service

testing for physicians whose patients use these patient service centers, as well as from specimens received

directly from the IPA physicians. The Company completed the transfer of assets and assignment of the IPA

agreements to LabCorp and recorded a $1.5 million gain in the third quarter of 2003 in connection with the

Divestiture, which is included in “other operating (income) expense, net’’ within the consolidated statements of

operations.

The acquisition of Unilab was accounted for under the purchase method of accounting. As such, the cost

to acquire Unilab has been allocated to the assets and liabilities acquired based on estimated fair values as of

the closing date. The consolidated financial statements include the results of operations of Unilab subsequent to

the closing of the acquisition.

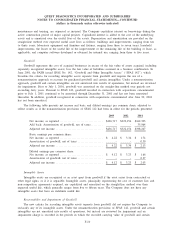

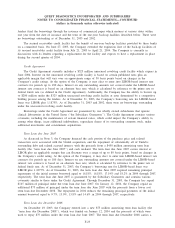

The following table summarizes the Company’s purchase price allocation related to the acquisition of

Unilab based on the estimated fair value of the assets acquired and liabilities assumed on the acquisition date.

Fair Values

as of

February 28, 2003

Current assets ......................................................... $193,798

Property, plant and equipment.......................................... 10,855

Goodwill ............................................................. 735,853

Other assets .......................................................... 47,777

Total assets acquired ................................................ 988,283

Current liabilities...................................................... 62,002

Long-term liabilities ................................................... 7,369

Long-term debt ....................................................... 221,291

Total liabilities assumed ............................................. 290,662

Net assets acquired ................................................. $697,621

Based on management’s review of the net assets acquired and consultations with third-party valuation

specialists, no intangible assets meeting the criteria under SFAS No. 141, “Business Combinations’’, were

F-14