Quest Diagnostics 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.our estimate of fair value for the Company to the book value of our consolidated net assets. If the book value

of our consolidated net assets is greater than our estimate of fair value, we would then proceed to the second

step to measure the impairment, if any. The second step compares the implied fair value of goodwill with its

carrying value. The implied fair value is determined by allocating the fair value of the reporting unit to all of

the assets and liabilities of that unit as if the reporting unit had been acquired in a business combination and

the fair value of the reporting unit was the purchase price paid to acquire the reporting unit. The excess of the

fair value of the reporting unit over the amounts assigned to its assets and liabilities is the implied fair value of

goodwill. If the carrying amount of the reporting unit’s goodwill is greater than its implied fair value, an

impairment loss will be recognized in the amount of the excess. We believe our estimation methods are

reasonable and reflective of common valuation practices.

On a quarterly basis, we perform a review of our business to determine if events or changes in

circumstances have occurred which could have a material adverse effect on the fair value of the Company and

its goodwill. If such events or changes in circumstances were deemed to have occurred, we would perform an

impairment test of goodwill as of the end of the quarter, consistent with the annual impairment test, and record

any noted impairment loss.

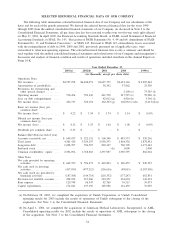

Acquisition of Unilab Corporation

On February 28, 2003, we completed the acquisition of Unilab Corporation, or Unilab, the leading

commercial clinical laboratory in California. In connection with the acquisition, we paid $297 million in cash

and issued 7.1 million shares of Quest Diagnostics common stock to acquire all of the outstanding capital stock

of Unilab. In addition, we reserved approximately 0.3 million shares of Quest Diagnostics common stock for

outstanding stock options of Unilab which were converted upon the completion of the acquisition into options

to acquire shares of Quest Diagnostics common stock. In connection with the acquisition of Unilab, as part of a

settlement agreement with the United States Federal Trade Commission, we entered into an agreement to sell to

Laboratory Corporation of America Holdings, Inc., or LabCorp, certain assets in northern California for $4.5

million, including the assignment of agreements with four IPA’s and leases for 46 patient service centers (five

of which also serve as rapid response laboratories), or the Divestiture. We completed the transfer of assets and

assignment of the IPA agreements to LabCorp and recorded a $1.5 million gain in the third quarter of 2003 in

connection with the Divestiture, which is included in “other operating (income) expense, net’’ in the

consolidated statements of operations. See Note 3 to the Consolidated Financial Statements for a full discussion

of the Unilab acquisition and the Divestiture.

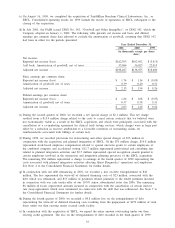

Integration of Acquired Businesses

In July 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal

Activities’’, or SFAS 146. SFAS 146, which we adopted effective January 1, 2003, requires that a liability for a

cost associated with an exit activity, including those related to employee termination benefits and contractual

obligations, be recognized when the liability is incurred, and not necessarily the date of an entity’s commitment

to an exit plan, as under previous accounting guidance. The provisions of SFAS 146 apply to integration costs

associated with actions that impact the employees and operations of Quest Diagnostics. Costs associated with

actions that impact the employees and operations of an acquired company, such as Unilab, are accounted for as

a cost of the acquisition and included in goodwill in accordance with Emerging Issues Task Force No. 95-3,

“Recognition of Liabilities in Connection with a Purchase Business Combination’’.

Unilab Corporation

As part of the Unilab acquisition, we acquired all of Unilab’s operations, including its primary testing

facilities in Los Angeles, San Jose and Sacramento, California, and approximately 365 patient service centers

and 35 rapid response laboratories and approximately 4,100 employees. During the fourth quarter of 2003, we

finalized our plan related to the integration of Unilab into our laboratory network. As part of the plan,

following the sale of certain assets to LabCorp as part of the Divestiture, we closed our previously owned

clinical laboratory in the San Francisco Bay area and completed the integration of remaining customers in the

northern California area to Unilab’s laboratories in San Jose and Sacramento. We continue to have two

laboratories in the Los Angeles metropolitan area (our facilities in Van Nuys and Tarzana). We plan to open a

new regional laboratory in the Los Angeles metropolitan area and then integrate our business in the Los

Angeles metropolitan area into the new facility.

41