Quest Diagnostics 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

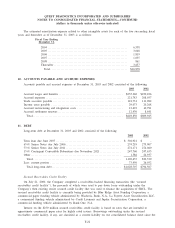

Letter of Credit Lines

In December 2003, the Company entered into two lines of credit with two financial institutions totaling

$68 million for the issuance of letters of credit (the “letter of credit lines’’). The letter of credit lines mature in

December 2004 and are guaranteed by the Subsidiary Guarantors. As of December 31, 2003, there $44 million

of outstanding letters of credit under the letter of credit lines.

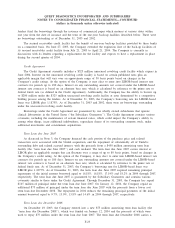

As of December 31, 2003, long-term debt, including capital leases, maturing in each of the years

subsequent to December 31, 2004, is as follows:

Year ending December 31,

2005........................................................................ $ 73,035

2006........................................................................ 351,790

2007........................................................................ 81,951

2008........................................................................ -

2009 and thereafter .......................................................... 521,931

Total long-term debt ....................................................... $1,028,707

The table above assumes that the Debentures are repaid at their stated maturity in 2021.

12. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00

per share. The Company’s Board of Directors has the authority to issue such shares without stockholder

approval and to determine the designations, preferences, rights and restrictions of such shares. Of the authorized

shares, 1,300,000 shares have been designated Series A Preferred Stock and 1,000 shares have been designated

Voting Cumulative Preferred Stock. No shares have been issued, other than the Voting Cumulative Preferred

Stock.

Voting Cumulative Preferred Stock

During the fourth quarter of 2001, the Company redeemed all of the then issued and outstanding shares of

preferred stock for $1 million plus accrued dividends. The Voting Cumulative Preferred Stock is generally

entitled to one vote per share, voting together as one class with the Company’s common stock. Whenever

dividends on the Voting Cumulative Preferred Stock are in arrears, no dividends or redemptions or purchases of

shares may be made with respect to any stock ranking junior as to dividends or liquidation to the Voting

Cumulative Preferred Stock until all such amounts have been paid. The Voting Cumulative Preferred Stock is

not convertible into shares of any other class or series of stock of the Company. The Voting Cumulative

Preferred Stock ranks senior to the Quest Diagnostics common stock and the Series A Preferred Stock.

Preferred Share Purchase Rights

Each share of Quest Diagnostics common stock trades with a preferred share purchase right, which entitles

stockholders to purchase one-hundredth of a share of Series A Preferred Stock upon the occurrence of certain

events. In conjunction with the SBCL acquisition, the Board of Directors of the Company approved an

amendment to the preferred share purchase rights. The amended rights entitle stockholders to purchase shares of

Series A Preferred Stock at a predefined price in the event a person or group (other than SmithKline Beecham)

acquires 20% or more of the Company’s outstanding common stock. The preferred share purchase rights expire

December 31, 2006.

F-25