Quest Diagnostics 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

maintenance and training, are expensed as incurred. The Company capitalizes interest on borrowings during the

active construction period of major capital projects. Capitalized interest is added to the cost of the underlying

assets and is amortized over the useful lives of the assets. Depreciation and amortization are provided on the

straight-line method over expected useful asset lives as follows: buildings and improvements, ranging from ten

to thirty years; laboratory equipment and furniture and fixtures, ranging from three to seven years; leasehold

improvements, the lesser of the useful life of the improvement or the remaining life of the building or lease, as

applicable; and computer software developed or obtained for internal use, ranging from three to five years.

Goodwill

Goodwill represents the cost of acquired businesses in excess of the fair value of assets acquired, including

separately recognized intangible assets, less the fair value of liabilities assumed in a business combination. In

June 2001, the FASB issued SFAS No. 142, “Goodwill and Other Intangible Assets’’ (“SFAS 142’’), which

broadens the criteria for recording intangible assets separate from goodwill and requires the use of a

nonamortization approach to account for purchased goodwill and certain intangibles. Under a nonamortization

approach, goodwill and certain intangibles are not amortized into results of operations, but instead are reviewed

for impairment. Prior to July 1, 2001, goodwill was amortized on the straight-line method over periods not

exceeding forty years. Pursuant to SFAS 142, goodwill recorded in connection with acquisitions consummated

prior to July 1, 2001 continued to be amortized through December 31, 2001 and has not been amortized

thereafter. In addition, goodwill recognized in connection with acquisitions consummated after June 30, 2001

has not been amortized.

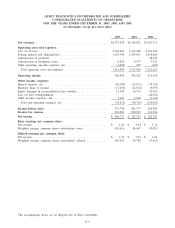

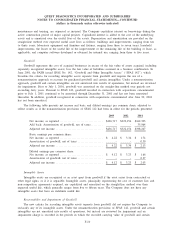

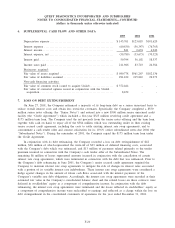

The following table presents net income and basic and diluted earnings per common share, adjusted to

reflect results as if the nonamortization provisions of SFAS 142 had been in effect for the periods presented:

2003 2002 2001

Net income, as reported ................................. $436,717 $322,154 $162,303

Add back: Amortization of goodwill, net of taxes ......... - - 35,964

Adjusted net income .................................... $436,717 $322,154 $198,267

Basic earnings per common share:

Net income, as reported ................................. $ 4.22 $ 3.34 $ 1.74

Amortization of goodwill, net of taxes ................... - - 0.39

Adjusted net income .................................... $ 4.22 $ 3.34 $ 2.13

Diluted earnings per common share:

Net income, as reported ................................. $ 4.12 $ 3.23 $ 1.66

Amortization of goodwill, net of taxes ................... - - 0.37

Adjusted net income .................................... $ 4.12 $ 3.23 $ 2.03

Intangible Assets

Intangible assets are recognized as an asset apart from goodwill if the asset arises from contractual or

other legal rights, or if it is separable. Intangible assets, principally representing the cost of customer lists and

non-competition agreements acquired, are capitalized and amortized on the straight-line method over their

expected useful life, which generally ranges from five to fifteen years. The Company does not have any

intangible assets that have an indefinite useful life.

Recoverability and Impairment of Goodwill

The new criteria for recording intangible assets separate from goodwill did not require the Company to

reclassify any of its intangible assets. Under the nonamortization provisions of SFAS 142, goodwill and certain

intangibles are not amortized into results of operations, but instead are reviewed for impairment and an

impairment charge is recorded in the periods in which the recorded carrying value of goodwill and certain

F-10