Quest Diagnostics 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

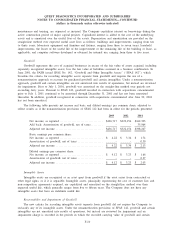

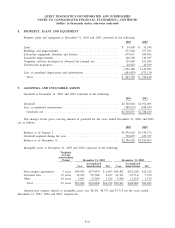

The components of income tax expense for 2003, 2002 and 2001 were as follows:

2003 2002 2001

Current:

Federal ........................................................ $214,729 $105,799 $107,629

State and local ................................................ 51,771 23,396 25,727

Foreign ....................................................... 728 627 1,490

Deferred:

Federal ........................................................ 29,271 73,002 (452)

State and local ................................................ 4,582 17,399 (108)

Total ........................................................ $301,081 $220,223 $134,286

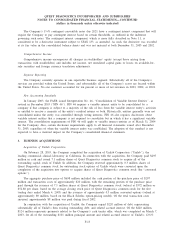

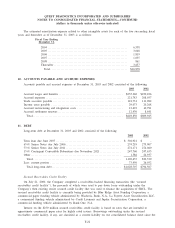

A reconciliation of the federal statutory rate to the Company’s effective tax rate for 2003, 2002 and 2001

was as follows:

2003 2002 2001

Tax provision at statutory rate .................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit ................ 5.0 5.0 5.0

Non-deductible goodwill amortization .............................. - - 4.4

Impact of foreign operations ...................................... 0.2 0.2 0.5

Non-deductible meals and entertainment expense ................... 0.3 0.3 0.4

Other, net ....................................................... 0.3 0.1 -

Effective tax rate .............................................. 40.8% 40.6% 45.3%

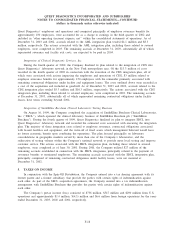

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets at

December 31, 2003 and 2002 were as follows:

2003 2002

Current deferred tax asset:

Accounts receivable reserve ..................................... $ 33,797 $ 30,449

Liabilities not currently deductible .............................. 65,352 67,173

Accrued settlement reserves .................................... 4,972 3,456

Accrued restructuring and integration costs ...................... 4,854 1,622

Total ........................................................ $108,975 $102,700

Non-current deferred tax asset:

Liabilities not currently deductible .............................. $ 44,978 $ 40,422

Net operating loss carryforwards ................................ 17,914 1,652

Accrued restructuring and integration costs ...................... 1,613 3,334

Depreciation and amortization .................................. (14,870) (15,652)

Total ........................................................ $ 49,635 $ 29,756

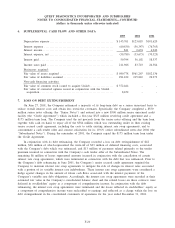

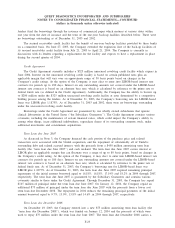

As of December 31, 2003, the Company had estimated net operating loss carryforwards for federal and

state income tax purposes of $45 million and $430 million, respectively, which expire at various dates through

2023. As of December 31, 2003 and 2002, deferred tax assets associated with net operating loss carryforwards

for federal and state income tax purposes of $51 million and $29 million, respectively, have each been reduced

by a valuation reserve of $33 million and $27 million respectively.

Income taxes payable at December 31, 2003 and 2002 were $29 million and $20 million, respectively, and

consisted primarily of federal income taxes payable of $22 million and $23 million, respectively.

F-19