Quest Diagnostics 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

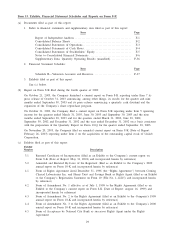

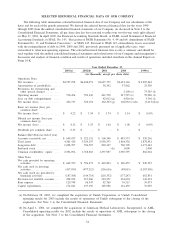

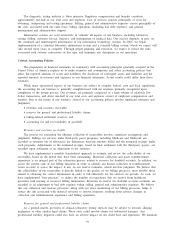

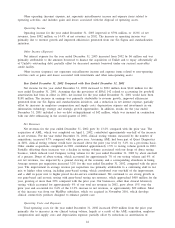

SELECTED HISTORICAL FINANCIAL DATA OF OUR COMPANY

The following table summarizes selected historical financial data of our Company and our subsidiaries at the

dates and for each of the periods presented. We derived the selected historical financial data for the years 1999

through 2003 from the audited consolidated financial statements of our Company. As discussed in Note 2 to the

Consolidated Financial Statements, all per share data has been restated to reflect our two-for-one stock split effected

on May 31, 2001. In April 2002, the Financial Accounting Standards Board, or FASB, issued Statement of Financial

Accounting Standards, or SFAS, No. 145, “Rescission of FASB Statements No. 4, 44 and 64, Amendment of FASB

Statement No. 13, and Technical Corrections’’, or SFAS 145. Pursuant to SFAS 145, extraordinary losses associated

with the extinguishment of debt in 1999, 2000 and 2001, previously presented net of applicable taxes, were

reclassified to other non-operating expenses. The selected historical financial data is only a summary and should be

read together with the audited consolidated financial statements and related notes of our Company and management’s

discussion and analysis of financial condition and results of operations included elsewhere in this Annual Report on

Form 10-K.

Year Ended December 31,

2003(a) 2002(b) 2001 2000 1999(c)

(in thousands, except per share data)

Operations Data:

Net revenues ..................... $4,737,958 $4,108,051 $3,627,771 $3,421,162 $ 2,205,243

Amortization of goodwill(d) ....... - - 38,392 37,862 23,530

Provisions for restructuring and

other special charges ........... - - - 2,100 (e) 73,385 (f)

Operating income ................ 796,454 592,142 411,550 317,527 (e) 78,980 (f)

Loss on debt extinguishment ...... - - 42,012 (g) 4,826 (h) 3,566 (i)

Net income (loss) ................ 436,717 322,154 162,303 (g) 102,052 (e),(h) (3,413)(f),(i)

Basic net income (loss) per

common share:

Net income (loss) ................ $ 4.22 $ 3.34 $ 1.74 $ 1.14 $ (0.05)

Diluted net income (loss) per

common share:(j)

Net income (loss) ................ $ 4.12 $ 3.23 $ 1.66 $ 1.08 $ (0.05)

Dividends per common share ...... $ 0.15 $ - $ - $ - $ -

Balance Sheet Data (at end of year):

Accounts receivable, net .......... $ 609,187 $ 522,131 $ 508,340 $ 485,573 $ 539,256

Total assets ...................... 4,301,418 3,324,197 2,930,555 2,864,536 2,878,481

Long-term debt .................. 1,028,707 796,507 820,337 760,705 1,171,442

Preferred stock ................... - - - (k) 1,000 1,000

Common stockholders’ equity ..... 2,394,694 1,768,863 1,335,987 1,030,795 862,062

Other Data:

Net cash provided by operating

activities ....................... $ 662,799 $ 596,371 $ 465,803 $ 369,455 $ 249,535

Net cash used in investing

activities ....................... (417,050) (477,212) (296,616) (48,015) (1,107,990)

Net cash (used in) provided by

financing activities ............. (187,568) (144,714) (218,332) (177,247) 682,831

Provision for doubtful accounts . . . . 228,222 217,360 218,271 234,694 142,333

Rent expense .................... 120,748 96,547 82,769 76,515 59,073

Capital expenditures .............. 174,641 155,196 148,986 116,450 76,029

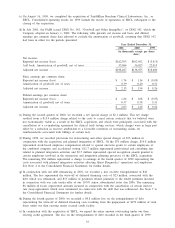

(a) On February 28, 2003, we completed the acquisition of Unilab Corporation, or Unilab. Consolidated

operating results for 2003 include the results of operations of Unilab subsequent to the closing of the

acquisition. See Note 3 to the Consolidated Financial Statements.

(b) On April 1, 2002, we completed the acquisition of American Medical Laboratories, Incorporated, or AML.

Consolidated operating results for 2002 include the results of operations of AML subsequent to the closing

of the acquisition. See Note 3 to the Consolidated Financial Statements.

34