Quest Diagnostics 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

Defined Contribution Plan

The Company maintains a qualified defined contribution plan covering substantially all of its employees.

During the year ended December 31, 2002, the ESOP, to which the Company made annual contributions equal

to 2% of eligible compensation, was merged into the Company’s defined contribution plan and the Company

increased its maximum matching contribution for its defined contribution plan from 4% to 6% of an employee’s

eligible wages. The Company’s expense for contributions to its defined contribution plan aggregated $54 million,

$42 million and $30 million for 2003, 2002 and 2001, respectively.

Supplemental Deferred Compensation Plan

The Company’s supplemental deferred compensation plan is an unfunded, non-qualified plan that provides

for certain management and highly compensated employees to defer up to 50% of their eligible compensation.

The compensation deferred under this plan, together with Company matching amounts, are credited with

earnings or losses measured by the mirrored rate of return on investments elected by plan participants. Each

plan participant is fully vested in all deferred compensation, Company match and earnings credited to their

account. Although the Company is currently contributing all participant deferrals and matching amounts to a

trust, the funds in the trust, totaling $19.2 million and $14.8 million at December 31, 2003 and 2002,

respectively, are general assets of the Company and are subject to any claims of the Company’s creditors. The

Company’s expense for matching contributions to this plan were $0.4 million, $0.4 million and $0.6 million for

2003, 2002 and 2001, respectively.

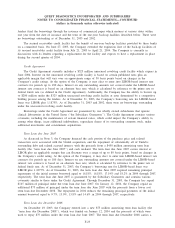

14. RELATED PARTY TRANSACTIONS

As a result of the merger of Glaxo Wellcome and SmithKline Beecham in December 2000,

GlaxoSmithKline plc (“GSK’’) currently beneficially owns approximately 22% of the outstanding shares of

Quest Diagnostics common stock.

As part of the SBCL acquisition agreements, SmithKline Beecham and Quest Diagnostics entered into data

access agreements under which Quest Diagnostics granted SmithKline Beecham and certain affiliated companies

certain non-exclusive rights and access to use Quest Diagnostics’ proprietary clinical laboratory information

database, which were terminated as of December 31, 2002.

In addition to the contracts outlined above, GSK has a long-term contractual relationship with Quest

Diagnostics under which Quest Diagnostics is the primary provider of testing to support GSK’s and SmithKline

Beecham’s clinical trials testing requirements worldwide (the “Clinical Trials Agreements’’).

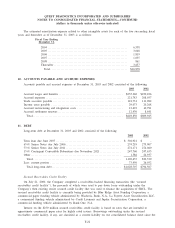

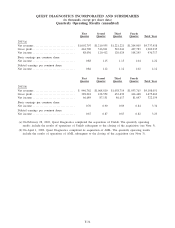

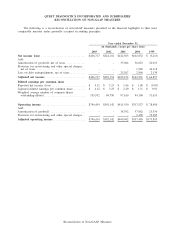

Significant transactions with GSK and SmithKline Beecham during 2003, 2002 and 2001 included:

2003 2002 2001

Net revenues, primarily derived under the Clinical Trials Agreements . . . $50,060 $32,822 $27,806

In addition, under the SBCL acquisition agreements, SmithKline Beecham has agreed to indemnify Quest

Diagnostics, on an after tax basis, against certain matters primarily related to taxes and billing and professional

liability claims.

At December 31, 2003 and 2002, accounts payable and accrued expenses included $21 million and $26

million, respectively, due to SmithKline Beecham, primarily related to tax benefits associated with indemnifiable

matters.

During 2001, the Company received $8.7 million from Corning related to certain indemnified billing-related

claims settled in 2001 and 2000.

F-29