Quest Diagnostics 2003 Annual Report Download - page 82

Download and view the complete annual report

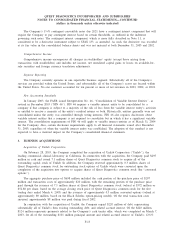

Please find page 82 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

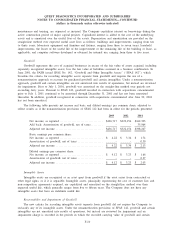

The Company’s 1

3

⁄

4

% contingent convertible notes due 2021 have a contingent interest component that will

require the Company to pay contingent interest based on certain thresholds, as outlined in the indenture

governing such notes. The contingent interest component, which is more fully described in Note 11, is

considered to be a derivative instrument subject to SFAS 133, as amended. As such, the derivative was recorded

at its fair value in the consolidated balance sheets and was not material at both December 31, 2003 and 2002.

Comprehensive Income

Comprehensive income encompasses all changes in stockholders’ equity (except those arising from

transactions with stockholders) and includes net income, net unrealized capital gains or losses on available-for-

sale securities and foreign currency translation adjustments.

Segment Reporting

The Company currently operates in one reportable business segment. Substantially all of the Company’s

services are provided within the United States, and substantially all of the Company’s assets are located within

the United States. No one customer accounted for ten percent or more of net revenues in 2003, 2002, or 2001.

New Accounting Standards

In January 2003, the FASB issued Interpretation No. 46, “Consolidation of Variable Interest Entities’’, as

revised in December 2003 (“FIN 46’’). FIN 46 requires a variable interest entity to be consolidated by a

company if that company is subject to a majority of the risk of loss from the variable interest entity’s activities

or entitled to receive a majority of the entity’s residual returns or both. Historically, entities generally were not

consolidated unless the entity was controlled through voting interests. FIN 46 also requires disclosures about

variable interest entities that a company is not required to consolidate but in which it has a significant variable

interest. The consolidation requirements of FIN 46 will apply to variable interest entities as of March 31, 2004

for the Company. Also, certain disclosure requirements apply to all financial statements issued after December

31, 2003, regardless of when the variable interest entity was established. The adoption of this standard is not

expected to have a material impact on the Company’s consolidated financial statements.

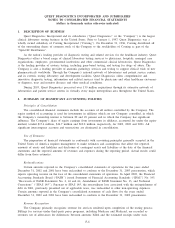

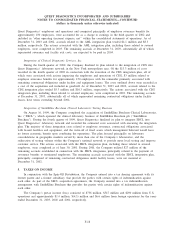

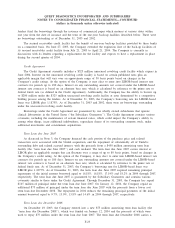

3. BUSINESS ACQUISITIONS

Acquisition of Unilab Corporation

On February 28, 2003, the Company completed the acquisition of Unilab Corporation (“Unilab’’), the

leading commercial clinical laboratory in California. In connection with the acquisition, the Company paid $297

million in cash and issued 7.1 million shares of Quest Diagnostics common stock to acquire all of the

outstanding capital stock of Unilab. In addition, the Company reserved approximately 0.3 million shares of

Quest Diagnostics common stock for outstanding stock options of Unilab which were converted upon the

completion of the acquisition into options to acquire shares of Quest Diagnostics common stock (the “converted

options’’).

The aggregate purchase price of $698 million included the cash portion of the purchase price of $297

million and transaction costs of approximately $20 million, with the remaining portion of the purchase price

paid through the issuance of 7.1 million shares of Quest Diagnostics common stock (valued at $372 million or

$52.80 per share, based on the average closing stock price of Quest Diagnostics common stock for the five

trading days ended March 4, 2003) and the issuance of approximately 0.3 million converted options (valued at

approximately $9 million, based on the Black Scholes option-pricing model). Of the total transaction costs

incurred, approximately $8 million was paid during fiscal 2002.

In conjunction with the acquisition of Unilab, the Company repaid $220 million of debt, representing

substantially all of Unilab’s then existing outstanding debt, and related accrued interest. Of the $220 million,

$124 million represents payments related to the Company’s cash tender offer, which was completed on March 7,

2003, for all of the outstanding $101 million principal amount and related accrued interest of Unilab’s 12

3

⁄

4

%

F-13