Quest Diagnostics 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.assumed 10% increase in interest rates (representing approximately 50 and 60 basis points at December 31,

2003 and 2002, respectively) would potentially reduce the estimated fair value of our debt by approximately

$17 million and $21 million, respectively, at December 31, 2003 and 2002.

The Debentures have a contingent interest component that will require us to pay contingent interest based

on certain thresholds, as outlined in the indenture governing the Debentures. The contingent interest component,

which is more fully described in Note 11 to the Consolidated Financial Statements, is considered to be a

derivative instrument subject to SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities’’,

as amended. As such, the derivative was recorded at its fair value in the consolidated balance sheets and was

not material at December 31, 2003 and 2002.

Borrowings under our unsecured revolving credit facility under our Credit Agreement, our term loan

facilities and our secured receivables credit facility are subject to variable interest rates, unless fixed through

interest rate swaps or other agreements. Interest rates on our unsecured revolving credit facility and term loans

are subject to a pricing schedule that can fluctuate based on changes in our credit rating. As such, our

borrowing cost under these credit arrangements will be subject to both fluctuations in interest rates and changes

in our credit rating. As of December 31, 2003, our borrowing rate for LIBOR-based loans was principally

LIBOR plus 1.1875%. At December 31, 2003, there was $305 million outstanding under our term loan due

June 2007 and there were no borrowings outstanding under our unsecured revolving credit facility or secured

receivables credit facility.

Based on our net exposure to interest rate changes, an assumed 10% change in interest rates on our

variable rate indebtedness (representing approximately 12 basis points) would impact annual net interest expense

by approximately $0.4 million, assuming no changes to the debt outstanding at December 31, 2003.

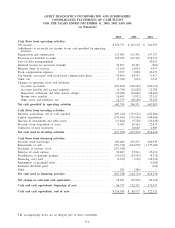

Liquidity and Capital Resources

Cash and Cash Equivalents

Cash and cash equivalents at December 31, 2003 totaled $155 million, compared to $97 million at

December 31, 2002. Cash flows from operating activities in 2003 provided cash of $663 million, which together

with cash on-hand were used to fund investing and financing activities, which required cash of $417 million

and $188 million, respectively. Cash and cash equivalents at December 31, 2002 totaled $97 million, a decrease

of $26 million from December 31, 2001. Cash flows from operating activities in 2002 provided cash of $596

million, which together with cash on-hand were used to fund investing and financing activities, which required

cash of $477 million and $145 million, respectively.

Cash Flows from Operating Activities

Net cash provided by operating activities for 2003 was $663 million compared to $596 million in the prior

year period. This increase was primarily due to improved operating performance, partially offset by an increase

in accounts receivable associated with growth in net revenues. Days sales outstanding, a measure of billing and

collection efficiency, improved to 48 days at December 31, 2003 from 49 days at December 31, 2002. Net cash

provided by operating activities for 2002 benefited from our ability to accelerate the tax deduction for certain

operating expenses resulting from Internal Revenue Service rule changes.

Net cash from operating activities for 2002 was $131 million higher than the 2001 level. This increase was

primarily due to improved operating performance, our ability to accelerate the tax deductions resulting from

Internal Revenue Service rule changes, efficiencies in our billing and collection processes and a reduction in

SBCL integration costs paid. The increase was partially offset by settlement payments, primarily related to

contractual disputes previously reserved for, and a decrease in the tax benefits realized associated with the

exercise of employee stock options. The year-over-year comparisons were also impacted by the payment of

indemnifiable tax matters to GlaxoSmithKline in 2002 and cash received from Corning Incorporated in 2001

related to an indemnified billing-related claim. Days sales outstanding decreased to 49 days at December 31,

2002 from 54 days at December 31, 2001.

Cash Flows from Investing Activities

Net cash used in investing activities in 2003 was $417 million, consisting primarily of acquisition and

related transaction costs of $238 million to acquire the outstanding capital stock of Unilab and capital

expenditures of $175 million. The acquisition and related transaction costs included the cash portion of the

47