Quest Diagnostics 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

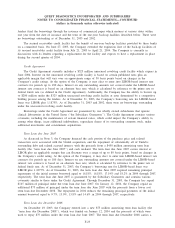

identified. Of the $736 million allocated to goodwill, approximately $85 million is expected to be deductible for

tax purposes.

Acquisition of American Medical Laboratories, Incorporated

On April 1, 2002, the Company completed its acquisition of all of the outstanding voting stock of

American Medical Laboratories, Incorporated, (“AML’’) and an affiliated company of AML, LabPortal, Inc.

(“LabPortal’’), a provider of electronic connectivity products, in an all-cash transaction with a combined value

of approximately $500 million, which included the assumption of approximately $160 million in debt.

Through the acquisition of AML, Quest Diagnostics acquired all of AML’s operations, including two

full-service laboratories, 51 patient service centers, and hospital sales, service and logistics capabilities. The

all-cash purchase price of approximately $335 million and related transaction costs, together with the repayment

of approximately $150 million of principal and related accrued interest, representing substantially all of AML’s

debt, was financed by Quest Diagnostics with cash on-hand, $300 million of borrowings under its secured

receivables credit facility and $175 million of borrowings under its unsecured revolving credit facility. During

2002, Quest Diagnostics repaid all of the $475 million in borrowings related to the acquisition of AML.

The acquisition of AML was accounted for under the purchase method of accounting. As such, the cost to

acquire AML has been allocated to the assets and liabilities acquired based on estimated fair values as of the

closing date. The consolidated financial statements include the results of operations of AML subsequent to the

closing of the acquisition.

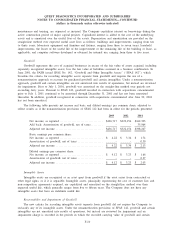

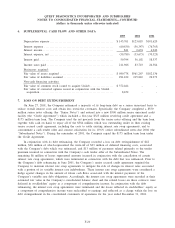

The following table summarizes the Company’s purchase price allocation related to the acquisition of AML

based on the estimated fair value of the assets acquired and liabilities assumed on the acquisition date.

Fair Values

as of

April 1, 2002

Current assets ............................................................. $ 83,403

Property, plant and equipment .............................................. 31,475

Goodwill .................................................................. 426,314

Other assets ............................................................... 8,211

Total assets acquired ..................................................... 549,403

Current portion of long-term debt ........................................... 11,834

Other current liabilities ..................................................... 51,403

Long-term debt ............................................................ 139,465

Other liabilities ............................................................ 4,925

Total liabilities assumed.................................................. 207,627

Net assets acquired ...................................................... $341,776

Based on management’s review of the net assets acquired and consultations with valuation specialists, no

intangible assets meeting the criteria under SFAS No. 141, “Business Combinations’’, were identified. Of the

$426 million allocated to goodwill, approximately $17 million is expected to be deductible for tax purposes.

Acquisition of LabPortal

The all-cash purchase price for LabPortal of approximately $4 million and related transaction costs,

together with the repayment of all of LabPortal’s outstanding debt of approximately $7 million and related

accrued interest, was financed by Quest Diagnostics with cash on-hand. The acquisition of LabPortal was

accounted for under the purchase method of accounting. As such, the cost to acquire LabPortal has been

allocated to the assets and liabilities acquired based on estimated fair values as of the closing date, including

approximately $8 million of goodwill. The consolidated financial statements include the results of operations of

LabPortal subsequent to the closing of the acquisition.

F-15