Quest Diagnostics 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

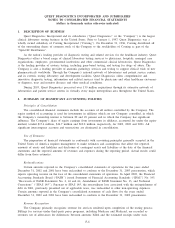

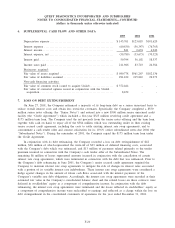

Pro Forma Combined Financial Information

The following unaudited pro forma combined financial information for the years ended December 31, 2003

and 2002 assumes that the Unilab and AML acquisitions and the Divestiture were completed on January 1,

2002. The unaudited pro forma combined financial information for the year ended December 31, 2001 assumes

that the AML acquisition was completed on January 1, 2001 (in thousands, except per share data):

2003 2002 2001

Net revenues................................................ $4,803,875 $4,607,242 $3,925,418

Net income ................................................. 444,944 365,448 171,346

Basic earnings per common share:

Net income ................................................. $ 4.26 $ 3.53 $ 1.84

Weighted average common shares outstanding—basic .......... 104,552 103,522 93,053

Diluted earnings per common share:

Net income ................................................. $ 4.16 $ 3.42 $ 1.76

Weighted average common shares outstanding—diluted ........ 107,079 106,926 97,610

The pro forma combined financial information presented above reflects certain reclassifications to the

historical financial statements of Unilab and AML to conform the acquired companies’ accounting policies and

classification of certain costs and expenses to that of Quest Diagnostics. These adjustments had no impact on

pro forma net income. Pro forma results for the year ended December 31, 2003 exclude $14.5 million of direct

transaction costs, which were incurred and expensed by Unilab in conjunction with its acquisition by Quest

Diagnostics. Pro forma results for the year ended December 31, 2002 exclude $14.5 million and $6.3 million,

respectively, of direct transaction costs, which were incurred and expensed by AML and Unilab, respectively, in

conjunction with their acquisitions by Quest Diagnostics.

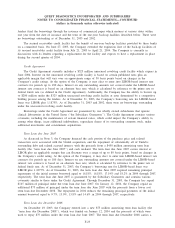

2001 Acquisitions

During 2001, the Company acquired the assets of Clinical Laboratories of Colorado, LLC and the assets of

Las Marias Reference Lab Corp. and Laboratorio Clinico Las Marias, Inc., a clinical laboratory based in San

Juan, Puerto Rico. During 2001, the Company also acquired the outstanding voting shares that it did not

already own of MedPlus, Inc., a leading developer and integrator of clinical connectivity and data management

solutions for healthcare organizations and clinicians, and all of the voting stock of Clinical Diagnostic Services,

Inc. (“CDS’’), which operated a diagnostic testing laboratory and more than 50 patient service centers in New

York and New Jersey. Additionally, during 2001, the Company acquired the minority ownership interest of a

consolidated joint venture from its joint venture partner. The combined purchase price for these acquisitions was

$155 million, which was paid primarily in cash.

The Company accounted for the above acquisitions under the purchase method of accounting. In connection

with the above transactions, the Company recorded $153 million of goodwill during 2001, representing

acquisition costs in excess of the fair value of net assets acquired, and approximately $8 million associated with

non-compete agreements. The amounts paid under the non-compete agreements are being amortized on the

straight-line basis over their five-year terms. During 2002, the Company recorded approximately $4 million of

adjustments to finalize the purchase price allocations associated with the businesses acquired in 2001, primarily

related to accruals for integration costs for actions impacting the employees and operations of the acquired

businesses, partially offset by adjustments to finalize the deferred tax position of the acquired entities.

The historical financial statements of Quest Diagnostics include the results of operations of each acquired

company subsequent to the closing of the respective acquisition.

4. INTEGRATION OF ACQUIRED BUSINESSES

In July 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal

Activities’’ (“SFAS 146’’). SFAS 146, which the Company adopted effective January 1, 2003, requires that a

liability for a cost associated with an exit activity, including those related to employee termination benefits and

contractual obligations, be recognized when the liability is incurred, and not necessarily the date of an entity’s

F-16