Quest Diagnostics 2003 Annual Report Download - page 65

Download and view the complete annual report

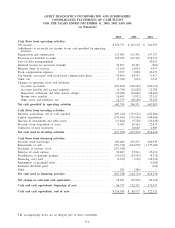

Please find page 65 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Unilab purchase price of $297 million and approximately $12 million of transaction costs paid in 2003, partially

offset by $72 million of cash acquired from Unilab.

Net cash used in investing activities in 2002 was $477 million, consisting primarily of acquisition and

related costs of $334 million, primarily to acquire the outstanding voting stock of AML, and capital

expenditures of $155 million.

Cash Flows from Financing Activities

Net cash used in financing activities in 2003 was $188 million, consisting primarily of debt repayments

totaling $392 million and purchases of treasury stock totaling $258 million, partially offset by $450 million of

borrowings under our term loan due June 2007. Borrowings under our term loan due June 2007 were used to

finance the cash portion of the purchase price and related transaction costs associated with the acquisition of

Unilab, and to repay $220 million of debt, representing substantially all of Unilab’s then existing outstanding

debt, and related accrued interest. Of the $220 million, $124 million represented payments related to our cash

tender offer, which was completed on March 7, 2003, for all of the outstanding $101 million principal amount

of Unilab’s 12

3

⁄

4

% Senior Subordinated Notes due 2009 and $23 million of related tender premium and

associated tender offer costs. The remaining debt repayments in 2003 consisted primarily of $145 million of

repayments under our term loan due June 2007 and $24 million of capital lease repayments. The $258 million

in treasury stock purchases represents 4.0 million shares of our common stock repurchased at an average price

of $64.54 per share.

Net cash used in financing activities in 2002 was $145 million, consisting primarily of the net cash activity

associated with the financing of the AML acquisition. We financed AML’s all-cash purchase price of

approximately $335 million and related transaction costs, together with the repayment of approximately $150

million of acquired AML debt and accrued interest with cash on-hand, $300 million of borrowings under our

secured receivables credit facility and $175 million of borrowings under our unsecured revolving credit facility.

During the last three quarters of 2002, we repaid all of the $475 million in borrowings related to the

acquisition of AML.

Dividend Policy

Through October 20, 2003, we had never declared or paid cash dividends on our common stock. On

October 21, 2003, our Board of Directors declared the payment of a quarterly cash dividend of $0.15 per

common share. The initial quarterly dividend was paid on January 23, 2004 to shareholders of record on

January 8, 2004 and totaled $15.4 million. We expect to fund future dividend payments with cash flows from

operations, and do not expect the dividend to have a material impact on our ability to finance future growth.

Share Repurchase Plan

In May 2003, our Board of Directors authorized a share repurchase program, which permits us to purchase

up to $300 million of our common stock. In October 2003, our Board of Directors increased our share

repurchase authorization by an additional $300 million. Through December 31, 2003, we have repurchased 4.0

million shares of our common stock at an average price of $64.54 per share for a total of $258 million under

the program. We expect to fund the share repurchase program with cash flows from operations and do not

expect the share repurchase program to have a material impact on our ability to finance future growth.

Contingent Convertible Debentures

On November 30, 2004, 2005, 2008, 2012 and 2016 each holder of the Debentures may require us to

repurchase the holder’s Debentures for the principal amount of the Debentures plus any accrued and unpaid

interest. We may repurchase the $250 million Debentures for cash, common stock, or a combination of both.

We expect to settle any repurchases from any put on the Debentures with a cash payment, funding such

payment with a combination of cash on-hand and borrowings under our credit facilities.

48