Quest Diagnostics 2003 Annual Report Download - page 93

Download and view the complete annual report

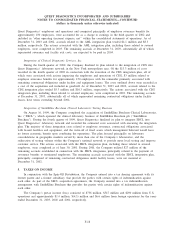

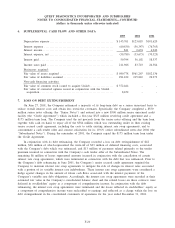

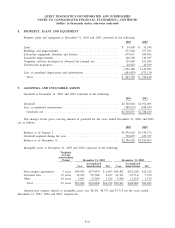

Please find page 93 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

lower interest rate than the term loan due June 2007 and is based on LIBOR plus an applicable margin that

can fluctuate over a range of up to 119 basis points, based on changes in the Company’s public debt rating. At

the option of the Company, it may elect to enter into LIBOR-based interest rate contracts for periods up to 180

days. Interest on any outstanding amounts not covered under the LIBOR-based interest rate contracts is based

on an alternate base rate, which is calculated by reference to the prime rate or federal funds rate. As of

December 31, 2003, the Company’s borrowing rate for LIBOR-based loans was LIBOR plus 0.55%. The term

loan due December 2008 requires principal repayments of the initial amount borrowed equal to 20% on each of

the third and fourth anniversary dates of the funding and the remainder of the outstanding balance on

December 31, 2008. The term loan due December 2008 is guaranteed by the Subsidiary Guarantors and

contains various covenants similar to those under the Credit Agreement.

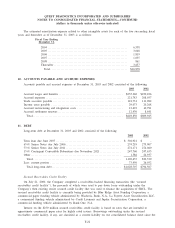

Senior Notes

In conjunction with its 2001 debt refinancing (see Note 7), the Company completed a $550 million senior

notes offering in June 2001. The Senior Notes were issued in two tranches: (a) $275 million aggregate principal

amount of 6

3

⁄

4

% senior notes due 2006 (“Senior Notes due 2006’’), issued at a discount of approximately $1.6

million and (b) $275 million aggregate principal amount of 7

1

⁄

2

% senior notes due 2011 (“Senior Notes due

2011’’), issued at a discount of approximately $1.1 million. After considering the discounts, the effective interest

rate on the Senior Notes due 2006 and Senior Notes due 2011 is 6.9% and 7.6%, respectively. The Senior

Notes require semiannual interest payments which commenced January 12, 2002. The Senior Notes are

unsecured obligations of the Company and rank equally with the Company’s other unsecured senior obligations.

The Senior Notes are guaranteed by the Subsidiary Guarantors and do not have a sinking fund requirement.

1

3

⁄

4

% Contingent Convertible Debentures

On November 26, 2001, the Company completed its $250 million offering of 1

3

⁄

4

% contingent convertible

debentures due 2021 (the “Debentures’’). The net proceeds of the offering, together with cash on hand, were

used to repay all of the $256 million principal that was then outstanding under the Company’s secured

receivables credit facility. The Debentures, which pay a fixed rate of interest semi-annually commencing on

May 31, 2002, have a contingent interest component, which is considered to be a derivative instrument subject

to SFAS 133, as amended, that will require the Company to pay contingent interest based on certain thresholds,

as outlined in the indenture governing the Debentures. For income tax purposes, the Debentures are considered

to be a contingent payment security. As such, interest expense for tax purposes is based on an assumed interest

rate related to a comparable fixed interest rate debt security issued by the Company without a conversion

feature. The assumed interest rate for tax purposes was 7% for both 2003 and 2002.

The Debentures are guaranteed by the Subsidiary Guarantors and do not have a sinking fund requirement.

Each one thousand dollar principal amount of Debentures is convertible initially into 11.429 shares of the

Company’s common stock, which represents an initial conversion price of $87.50 per share. Holders may

surrender the Debentures for conversion into shares of the Company’s common stock under any of the following

circumstances: (1) if the sales price of the Company’s common stock is above 120% of the conversion price (or

$105 per share) for specified periods; (2) if the Company calls the Debentures or (3) if specified corporate

transactions have occurred.

The Company may call the Debentures at any time on or after November 30, 2004 for the principal

amount of the Debentures plus any accrued and unpaid interest. On November 30, 2004, 2005, 2008, 2012 and

2016 each holder of the Debentures may require the Company to repurchase the holder’s Debentures for the

principal amount of the Debentures plus any accrued and unpaid interest. The Company may repurchase the

Debentures for cash, common stock, or a combination of both. The Company intends to settle any repurchases

with a cash payment, funding such payment with a combination of cash on-hand and borrowings under its

unsecured revolving credit facility. The Debentures are classified as long-term debt on the consolidated balance

sheet at December 31, 2003 due to the Company’s existing ability and intent to refinance the Debentures on a

long-term basis in the event the Debentures are put to the Company in November 2004.

F-24