Quest Diagnostics 2003 Annual Report Download - page 100

Download and view the complete annual report

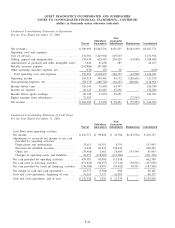

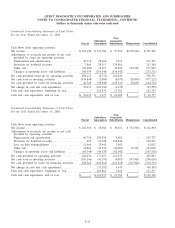

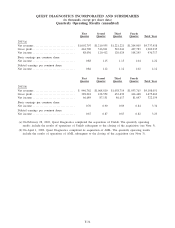

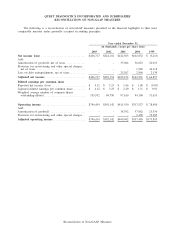

Please find page 100 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

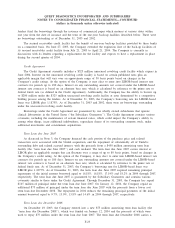

As a general matter, providers of clinical laboratory testing services may be subject to lawsuits alleging

negligence or other similar legal claims. These suits could involve claims for substantial damages. Any

professional liability litigation could also have an adverse impact on the Company’s client base and reputation.

The Company maintains various liability insurance programs for claims that could result from providing or

failing to provide clinical laboratory testing services, including inaccurate testing results and other exposures.

The Company’s insurance coverage limits its maximum exposure on individual claims; however, the Company is

essentially self-insured for a significant portion of these claims. The basis for claims reserves incorporates

actuarially determined losses based upon the Company’s historical and projected loss experience. Management

believes that present insurance coverage and reserves are sufficient to cover currently estimated exposures.

Although management cannot predict the outcome of any claims made against the Company, management does

not anticipate that the ultimate outcome of any such proceedings or claims will have a material adverse effect

on the Company’s financial position but may be material to the Company’s results of operations and cash flows

in the period in which such claims are resolved.

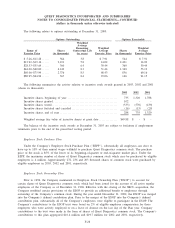

16. SUMMARIZED FINANCIAL INFORMATION

As described in Note 11, the Senior Notes and the Debentures are guaranteed by the Subsidiary

Guarantors. With the exception of Quest Diagnostics Receivables Incorporated (see paragraph below), the

non-guarantor subsidiaries are primarily foreign and less than wholly owned subsidiaries.

In conjunction with the Company’s secured receivables credit facility described in Note 11, the Company

formed a new wholly owned non-guarantor subsidiary, Quest Diagnostics Receivables Incorporated (“QDRI’’).

The Company and the Subsidiary Guarantors, with the exception of AML and Unilab, transfer all private

domestic receivables (principally excluding receivables due from Medicare, Medicaid and other federal programs,

and receivables due from customers of its joint ventures) to QDRI. QDRI utilizes the transferred receivables to

collateralize the Company’s secured receivables credit facility. The Company and the Subsidiary Guarantors

provide collection services to QDRI. QDRI uses cash collections principally to purchase new receivables from

the Company and the Subsidiary Guarantors.

The following condensed consolidating financial data illustrates the composition of the combined guarantors.

Investments in subsidiaries are accounted for by the parent using the equity method for purposes of the

supplemental consolidating presentation. Earnings (losses) of subsidiaries are therefore reflected in the parent’s

investment accounts and earnings. The principal elimination entries relate to investments in subsidiaries and

intercompany balances and transactions. On April 1, 2002, Quest Diagnostics acquired AML (see Note 3),

which has been included in the accompanying condensed consolidating financial data, subsequent to the closing

of the acquisition, as a Subsidiary Guarantor. On February 28, 2003, Quest Diagnostics acquired Unilab (see

Note 3), which has been included in the accompanying condensed consolidating financial data, subsequent to the

closing of the acquisition, as a Subsidiary Guarantor.

F-31