Quest Diagnostics 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

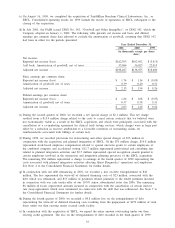

(c) On August 16, 1999, we completed the acquisition of SmithKline Beecham Clinical Laboratories, Inc., or

SBCL. Consolidated operating results for 1999 include the results of operations of SBCL subsequent to the

closing of the acquisition.

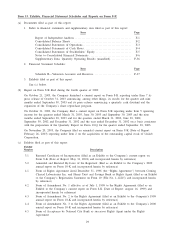

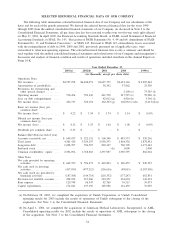

(d) In July 2001, the FASB issued SFAS No. 142, “Goodwill and Other Intangibles’’, or SFAS 142, which the

Company adopted on January 1, 2002. The following table presents net income and basic and diluted

earnings per common share data adjusted to exclude the amortization of goodwill, assuming that SFAS 142

had been in effect for the periods presented:

Year Ended December 31,

2001 2000 1999

(in thousands, except per share

data)

Net income:

Reported net income (loss) ........................................... $162,303 $102,052 $ (3,413)

Add back: Amortization of goodwill, net of taxes ..................... 35,964 36,023 22,013

Adjusted net income ................................................. $198,267 $138,075 $18,600

Basic earnings per common share:

Reported net income (loss) ........................................... $ 1.74 $ 1.14 $ (0.05)

Amortization of goodwill, net of taxes ................................ 0.39 0.40 0.31

Adjusted net income ................................................. $ 2.13 $ 1.54 $ 0.26

Diluted earnings per common share:

Reported net income (loss) ........................................... $ 1.66 $ 1.08 $ (0.05)

Amortization of goodwill, net of taxes ................................ 0.37 0.38 0.31

Adjusted net income ................................................. $ 2.03 $ 1.46 $ 0.26

(e) During the second quarter of 2000, we recorded a net special charge of $2.1 million. This net charge

resulted from a $13.4 million charge related to the costs to cancel certain contracts that we believed were

not economically viable as a result of the SBCL acquisition, and which were principally associated with the

cancellation of a co-marketing agreement for clinical trials testing services, which charges were in large part

offset by a reduction in reserves attributable to a favorable resolution of outstanding claims for

reimbursements associated with billings of certain tests.

(f) During 1999, we recorded provisions for restructuring and other special charges of $73 million in

conjunction with the acquisition and planned integration of SBCL. Of the $73 million charge, $19.8 million

represented stock-based employee compensation related to special one-time grants to certain employees of

the combined company and accelerated vesting, $12.7 million represented professional and consulting fees

related to planned integration activities and $3.5 million represented special recognition awards granted to

certain employees involved in the transaction and integration planning processes of the SBCL acquisition.

The remaining $36 million represented a charge to earnings in the fourth quarter of 1999 representing the

costs associated with planned integration activities affecting Quest Diagnostics’ operations and employees.

See Note 4 to the Consolidated Financial Statements for further details.

(g) In conjunction with our debt refinancing in 2001, we recorded a loss on debt extinguishment of $42

million. The loss represented the write-off of deferred financing costs of $23 million, associated with the

debt which was refinanced, and $13 million of payments related primarily to the tender premium incurred

in connection with our cash tender offer of our 10

3

⁄

4

% senior subordinated notes due 2006. The remaining

$6 million of losses represented amounts incurred in conjunction with the cancellation of certain interest

rate swap agreements which were terminated in connection with the debt that was refinanced. See Note 7 to

the Consolidated Financial Statements for further details.

(h) During the fourth quarter of 2000, we recorded a $4.8 million loss on the extinguishment of debt

representing the write-off of deferred financing costs resulting from the prepayment of $155 million of term

loans under our then existing senior secured credit facility.

(i) In conjunction with the acquisition of SBCL, we repaid the entire amount outstanding under our then

existing credit agreement. The loss on the extinguishment of debt recorded in the third quarter of 1999

35