Quest Diagnostics 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

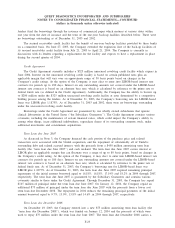

Quest Diagnostics’ employees and operations and comprised principally of employee severance benefits for

approximately 100 employees, were accounted for as a charge to earnings in the third quarter of 2002 and

included in “other operating (income) expense, net’’ within the consolidated statements of operations. As of

December 31, 2003 and 2002, accruals related to the AML integration plan totaled $4.1 million and $8.3

million, respectively. The actions associated with the AML integration plan, including those related to severed

employees, were completed in 2003. The remaining accruals at December 31, 2003, substantially all of which

represented severance and facility exit costs, are expected to be paid in 2004.

Integration of Clinical Diagnostic Services, Inc.

During the fourth quarter of 2002, the Company finalized its plan related to the integration of CDS into

Quest Diagnostics’ laboratory network in the New York metropolitan area. Of the $13.3 million of costs

recorded in the fourth quarter of 2002 in connection with the execution of the CDS integration plan, all of

which were associated with actions impacting the employees and operations of CDS, $3 million related to

employee severance benefits for approximately 150 employees with the remainder primarily associated with

remaining contractual obligations under facility and equipment leases. The costs outlined above were recorded as

a cost of the acquisition and included in goodwill. As of December 31, 2003 and 2002, accruals related to the

CDS integration plan totaled $5.3 million and $10.3 million, respectively. The actions associated with the CDS

integration plan, including those related to severed employees, were completed in 2003. The remaining accruals

at December 31, 2003, substantially all of which represented remaining contractual obligations under facility

leases, have terms extending beyond 2004.

Integration of SmithKline Beecham Clinical Laboratory Testing Business

On August 16, 1999, the Company completed the acquisition of SmithKline Beecham Clinical Laboratories,

Inc. (“SBCL’’), which operated the clinical laboratory business of SmithKline Beecham plc (“SmithKline

Beecham’’). During the fourth quarter of 1999, Quest Diagnostics finalized its plan to integrate SBCL into

Quest Diagnostics’ laboratory network and recorded the estimated costs associated with executing the integration

plan. The majority of these integration costs related to employee severance, contractual obligations associated

with leased facilities and equipment, and the write-off of fixed assets which management believed would have

no future economic benefit upon combining the operations. The plan focused principally on laboratory

consolidations in geographic markets served by more than one of the Company’s laboratories, and the

redirection of testing volume within the Company’s national network to provide more local testing and improve

customer service. The actions associated with the SBCL integration plan, including those related to severed

employees, were completed as of June 30, 2001. During 2001, the Company utilized $27 million of the

remaining accruals established in connection with the SBCL integration, principally related to the payment of

severance benefits to terminated employees. The remaining accruals associated with the SBCL integration plan,

principally comprised of remaining contractual obligations under facility leases, were not material at

December 31, 2002.

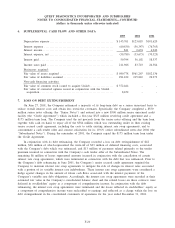

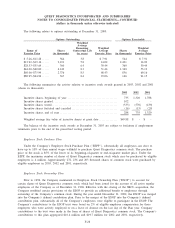

5. TAXES ON INCOME

In conjunction with the Spin-Off Distribution, the Company entered into a tax sharing agreement with its

former parent and a former subsidiary, that provide the parties with certain rights of indemnification against

each other. As part of the SBCL acquisition agreements, the Company entered into a tax indemnification

arrangement with SmithKline Beecham that provides the parties with certain rights of indemnification against

each other.

The Company’s pretax income (loss) consisted of $736 million, $547 million and $290 million from U.S.

operations and approximately $1.4 million, $(4.5) million and $6.6 million from foreign operations for the years

ended December 31, 2003, 2002 and 2001, respectively.

F-18