Quest Diagnostics 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

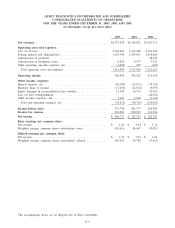

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

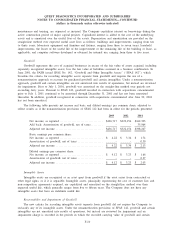

The fair value of each option grant was estimated on the date of grant using the Black-Scholes

option-pricing model with the following weighted average assumptions:

2003 2002 2001

Dividend yield .......................................... 0.0% 0.0% 0.0%

Risk-free interest rate.................................... 2.8% 4.2% 5.1%

Expected volatility ...................................... 48.1% 45.2% 47.7%

Expected holding period, in years ........................ 5 5 5

The majority of options granted in 2003 were issued prior to the declaration of the Company’s quarterly

cash dividend in the fourth quarter of 2003 and as such carry a dividend yield of 0%, thereby reducing the

weighted average dividend yield for 2003 to 0.0%.

Foreign Currency

Assets and liabilities of foreign subsidiaries are translated into U.S. dollars at year-end exchange rates.

Income and expense items are translated at average exchange rates prevailing during the year. The translation

adjustments are recorded as a component of accumulated other comprehensive income (loss) within stockholders’

equity. Gains and losses from foreign currency transactions are included within “other operating (income)

expense, net’’ in the consolidated statements of operations. Transaction gains and losses have not been material.

Cash and Cash Equivalents

Cash and cash equivalents include all highly-liquid investments with maturities, at the time acquired by the

Company, of three months or less.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk are principally

cash, cash equivalents, short-term investments and accounts receivable. The Company’s policy is to place its

cash, cash equivalents and short-term investments in highly rated financial instruments and institutions.

Concentration of credit risk with respect to accounts receivable is mitigated by the diversity of the Company’s

clients and their dispersion across many different geographic regions, and is limited to certain customers who

are large buyers of the Company’s services. To reduce risk, the Company routinely assesses the financial

strength of these customers and, consequently, believes that its accounts receivable credit risk exposure, with

respect to these customers, is limited. While the Company has receivables due from federal and state

governmental agencies, the Company does not believe that such receivables represent a credit risk since the

related healthcare programs are funded by federal and state governments, and payment is primarily dependent

on submitting appropriate documentation.

Inventories

Inventories, which consist principally of supplies, are valued at the lower of cost (first in, first out method)

or market.

Property, Plant and Equipment

Property, plant and equipment is recorded at cost. Major renewals and improvements are capitalized, while

maintenance and repairs are expensed as incurred. Costs incurred for computer software developed or obtained

for internal use are capitalized for application development activities and expensed as incurred for preliminary

project activities and post-implementation activities. Capitalized costs include external direct costs of materials

and services consumed in developing or obtaining internal-use software, payroll and payroll-related costs for

employees who are directly associated with and who devote time to the internal-use software project and

interest costs incurred, when material, while developing internal-use software. Capitalization of such costs ceases

when the project is substantially complete and ready for its intended purpose. Certain costs, such as

F-9