Quest Diagnostics 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(dollars in thousands unless otherwise indicated)

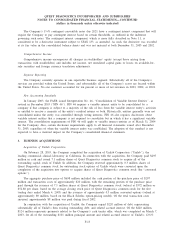

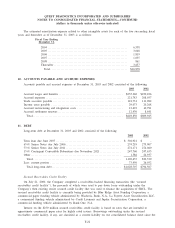

The estimated amortization expense related to other intangible assets for each of the five succeeding fiscal

years and thereafter as of December 31, 2003 is as follows:

Fiscal Year Ending

December 31,

2004 ............................................................. 6,558

2005 ............................................................. 3,048

2006 ............................................................. 1,819

2007 ............................................................. 1,035

2008 ............................................................. 861

Thereafter ........................................................ 3,657

Total ........................................................... $16,978

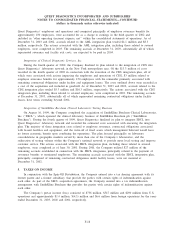

10. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at December 31, 2003 and 2002 consisted of the following:

2003 2002

Accrued wages and benefits ................................................. $255,340 $250,226

Accrued expenses ........................................................... 221,783 208,037

Trade accounts payable ...................................................... 118,731 111,982

Income taxes payable ....................................................... 29,073 20,268

Accrued restructuring and integration costs ................................... 12,493 10,791

Accrued settlement reserves .................................................. 12,430 8,641

Total ..................................................................... $649,850 $609,945

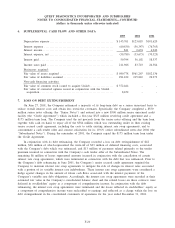

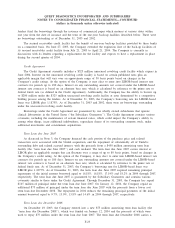

11. DEBT

Long-term debt at December 31, 2003 and 2002 consisted of the following:

2003 2002

Term loan due June 2007 .................................................. $ 304,921 $ -

6

3

⁄

4

% Senior Notes due July 2006 .......................................... 274,219 273,907

7

1

⁄

2

% Senior Notes due July 2011 .......................................... 274,171 274,060

1

3

⁄

4

% Contingent Convertible Debentures due November 2021 ................ 247,760 247,635

Other ..................................................................... 1,586 26,937

Total ................................................................... 1,102,657 822,539

Less: current portion ...................................................... 73,950 26,032

Total long-term debt..................................................... $1,028,707 $796,507

Secured Receivables Credit Facility

On July 21, 2000, the Company completed a receivables-backed financing transaction (the “secured

receivables credit facility’’), the proceeds of which were used to pay down loans outstanding under the

Company’s then existing senior secured credit facility that was used to finance the acquisition of SBCL. The

secured receivables credit facility is currently being provided by Blue Ridge Asset Funding Corporation, a

commercial paper funding vehicle administered by Wachovia Bank, N.A., La Fayette Asset Securitization LLC,

a commercial funding vehicle administered by Credit Lyonnais and Jupiter Securitization Corporation, a

commercial funding vehicle administered by Bank One, N.A.

Interest on the $250 million secured receivables credit facility is based on rates that are intended to

approximate commercial paper rates for highly rated issuers. Borrowings outstanding under the secured

receivables credit facility, if any, are classified as a current liability on our consolidated balance sheet since the

F-22