Quest Diagnostics 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

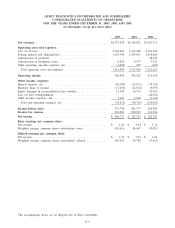

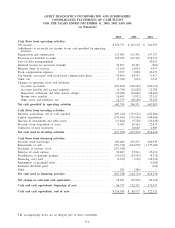

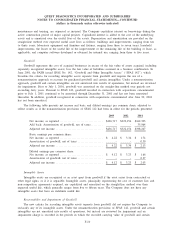

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

(in thousands)

Retained Accumulated

Additional Earnings Unearned Other Compre-

Common Paid-In (Accumulated Compen- Comprehensive Treasury hensive

Stock Capital Deficit) sation Income (Loss) Stock Income

Balance, December 31, 2000 ............ $ 465 $1,591,976 $(525,111) $(31,077) $ (5,458) $ -

Net income ............................ 162,303 $162,303

Other comprehensive income ............ 1,988 1,988

Comprehensive income .................. $164,291

Two-for-one stock split

(47,149 common shares) .............. 472 (472)

Preferred dividends declared ............. (118)

Issuance of common stock under benefit

plans (233 common shares) ........... 2 25,040 (3,540)

Exercise of stock options

(2,101 common shares) ............... 21 25,610

Tax benefits associated with stock-based

compensation plans ................... 71,917

Adjustment to Corning receivable ........ 605

Amortization of unearned compensation . . . 21,364

Balance, December 31, 2001 ............ 960 1,714,676 (362,926) (13,253) (3,470) -

Net income ............................ 322,154 $322,154

Other comprehensive loss ............... (2,054) (2,054)

Comprehensive income .................. $320,100

Issuance of common stock under benefit

plans (418 common shares) ........... 4 31,310

Exercise of stock options

(1,521 common shares) ............... 16 27,018

Tax benefits associated with stock-based

compensation plans ................... 44,507

Amortization of unearned compensation . . . 9,921

Balance, December 31, 2002 ............ 980 1,817,511 (40,772) (3,332) (5,524) -

Net income ............................ 436,717 $436,717

Other comprehensive income ............ 11,471 11,471

Comprehensive income .................. $448,188

Dividend declared ...................... (15,386)

Shares issued to acquire Unilab

(7,055 common shares) ............... 71 372,393

Fair value of Unilab converted options .... 8,452

Issuance of common stock under benefit

plans (400 common shares) ........... 4 18,081 (4,313)

Exercise of stock options

(1,567 common shares) ............... 15 29,872

Shares to cover employee payroll tax

withholdings on stock issued under

benefit plans (181 common shares) ..... (2) (9,791)

Tax benefits associated with stock-based

compensation plans ................... 30,496

Amortization of unearned compensation . . . 5,299

Purchases of treasury stock

(3,990 common shares) ............... (257,548)

Balance, December 31, 2003 ............ $1,068 $2,267,014 $ 380,559 $ (2,346) $ 5,947 $(257,548)

The accompanying notes are an integral part of these statements.

F-5