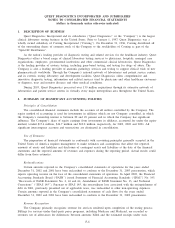

Quest Diagnostics 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

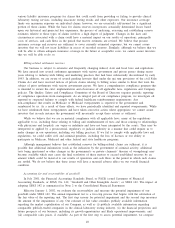

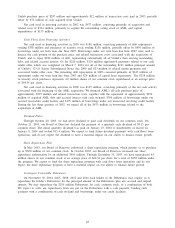

Contractual Obligations and Commitments

The following table summarizes certain of our contractual obligations as of December 31, 2003. See

Notes 11 and 15 to the Consolidated Financial Statements for further details.

Payments due by period

(in thousands)

Less than After

Contractual Obligations Total 1 year 1–3 years 4–5 years 5 years

Long-term debt ................................... $1,101,071 $ 72,817 $424,404 $ 81,919 $521,931

Capital lease obligations .......................... 1,586 1,133 421 32 -

Operating leases .................................. 529,781 122,596 170,236 100,799 136,150

Purchase obligations .............................. 75,046 39,269 35,420 202 155

Total contractual obligations .................. $1,707,484 $235,815 $630,481 $182,952 $658,236

See Note 11 to the Consolidated Financial Statements for a full description of the terms of our

indebtedness and related debt service requirements. A full discussion and analysis regarding our minimum rental

commitments under noncancelable operating leases, noncancelable commitments to purchase products or services,

and reserves with respect to insurance and billing-related claims is contained in Note 15 to the Consolidated

Financial Statements.

In December 2003, we entered into two lines of credit with two financial institutions totaling $68 million

for the issuance of letters of credit, which mature in December 2004. Standby letters of credit are obtained,

principally in support of our risk management program, to ensure our performance or payment to third parties

and amounted to $57 million at December 31, 2003, of which $44 million was issued against the $68 million

letter of credit lines with the remaining $13 million issued against our $325 million unsecured revolving credit

facility. The letters of credit, which are renewed annually, primarily represent collateral for automobile liability

and workers’ compensation loss payments.

Our credit agreements relating to our unsecured revolving credit facility and our term loan facilities contain

various covenants and conditions, including the maintenance of certain financial ratios, that could impact our

ability to, among other things, incur additional indebtedness, repurchase shares of our outstanding common

stock, make additional investments and consummate acquisitions. We do not expect these covenants to adversely

impact our ability to execute our growth strategy or conduct normal business operations.

Unconsolidated Joint Ventures

We have investments in unconsolidated joint ventures in Phoenix, Arizona; Indianapolis, Indiana; and

Dayton, Ohio, which are accounted for under the equity method of accounting. We believe that our transactions

with our joint ventures are conducted at arm’s length, reflecting current market conditions and pricing. Total net

revenues of our unconsolidated joint ventures, on a combined basis, are less than 6% of our consolidated net

revenues. Total assets associated with our unconsolidated joint ventures are less than 3% of our consolidated

total assets. We have no material unconditional obligations or guarantees to, or in support of, our unconsolidated

joint ventures and their operations.

Requirements and Capital Resources

We estimate that we will invest approximately $180 million to $190 million during 2004 for capital

expenditures to support and expand our existing operations, principally related to investments in information

technology, equipment, and facility upgrades. During January 2004, $13 million in letters of credit issued

against our $325 million unsecured revolving credit facility were cancelled and $17 million of letters of credit

were issued under the letter of credit lines. As of February 26, 2004, all of the $325 million unsecured

revolving credit facility and all of the $250 million secured receivables credit facility remained available to us

for future borrowing. Our secured receivables credit facility is set to expire on April 21, 2004. We are currently

in discussions with our lenders regarding a replacement for the facility and expect to have a replacement in

place during the second quarter of 2004. If in the unexpected instance the facility is not renewed, we expect

that other sources of liquidity could be readily obtained.

We believe that cash from operations and our borrowing capacity under our credit facilities and any

replacement facilities will provide sufficient financial flexibility to meet seasonal working capital requirements

and to fund capital expenditures, debt service requirements, cash dividends on common shares, share repurchases

49