Quest Diagnostics 2003 Annual Report Download - page 56

Download and view the complete annual report

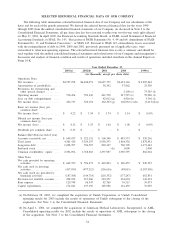

Please find page 56 of the 2003 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The diagnostic testing industry is labor intensive. Employee compensation and benefits constitute

approximately one-half of our total costs and expenses. Cost of services consists principally of costs for

obtaining, transporting and testing specimens. Selling, general and administrative expenses consist principally of

the costs associated with our sales force, billing operations (including bad debt expense), and general

management and administrative support.

Information systems are used extensively in virtually all aspects of our business, including laboratory

testing, billing, customer service, logistics, and management of medical data. Our success depends, in part, on

the continued and uninterrupted performance of our information technology systems. In 2002, we began

implementation of a standard laboratory information system and a standard billing system, which we expect will

take several more years to complete. Through proper planning and execution, we expect to reduce the risks

associated with systems conversions of this type, and minimize any disruptions in our operations.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires us to make estimates and assumptions and select accounting policies that

affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities and the

reported amounts of revenues and expenses in our financial statements. Actual results could differ from those

estimates.

While many operational aspects of our business are subject to complex federal, state and local regulations,

the accounting for our business is generally straightforward with net revenues primarily recognized upon

completion of the testing process. Our revenues are primarily comprised of a high volume of relatively low

dollar transactions, and about one-half of our total costs and expenses consist of employee compensation and

benefits. Due to the nature of our business, several of our accounting policies involve significant estimates and

judgments:

•revenues and accounts receivable;

•reserves for general and professional liability claims;

•billing-related settlement reserves; and

•accounting for and recoverability of goodwill.

Revenues and accounts receivable

The process for estimating the ultimate collection of receivables involves significant assumptions and

judgments. Billings for services under third-party payer programs, including Medicare and Medicaid, are

recorded as revenues net of allowances for differences between amounts billed and the estimated receipts under

such programs. Adjustments to the estimated receipts, based on final settlement with the third-party payers, are

recorded upon settlement as an adjustment to net revenues.

We have implemented a monthly standardized approach to estimate and review the collectibility of our

receivables based on the period they have been outstanding. Historical collection and payer reimbursement

experience is an integral part of the estimation process related to reserves for doubtful accounts. In addition, we

assess the current state of our billing functions in order to identify any known collection or reimbursement

issues in order to assess the impact, if any, on our reserve estimates, which involves judgment. We believe that

the collectibility of our receivables is directly linked to the quality of our billing processes, most notably those

related to obtaining the correct information in order to bill effectively for the services we provide. As such, we

have implemented “best practices’’ to reduce the number of requisitions that we receive from healthcare

providers with missing or incorrect billing information. Revisions in reserve for doubtful accounts estimates are

recorded as an adjustment to bad debt expense within selling, general and administrative expenses. We believe

that our collection and reserves processes, along with our close monitoring of our billing processes, helps to

reduce the risk associated with material revisions to reserve estimates resulting from adverse changes in

collection and reimbursement experience and billing operations.

Reserves for general and professional liability claims

As a general matter, providers of clinical laboratory testing services may be subject to lawsuits alleging

negligence or other similar legal claims. These suits could involve claims for substantial damages. Any

professional liability litigation could also have an adverse impact on our client base and reputation. We maintain

39