Quest Diagnostics 2000 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-28

governmental claims. The indemnification with respect to governmental claims is for 100% of those claims. SmithKline

Beecham will indemnify Quest Diagnostics, in respect of private claims for: 100% of those claims, up to an aggregate

amount of $80 million; 50% of those claims to the extent the aggregate amount exceeds $80 million but is less than $130

million; and 100% of such claims to the extent the aggregate amount exceeds $130 million. The indemnification also

covers 80% of out-of-pocket costs and expenses relating to investigations of the claims indemnified against by

SmithKline Beecham. SmithKline Beecham has also agreed to indemnify the Company with respect to pending actions

relating to a former SBCL employee that at times reused certain needles when drawing blood from patients. In addition,

SmithKline Beecham has agreed to indemnify the Company against all monetary payments relating to professional

liability claims of SBCL for services provided prior to the closing of the SBCL acquisition.

Amounts due from SmithKline Beecham at December 31, 2000 related to indemnified billing, professional

liability and other claims discussed above, totaled approximately $58 million and represented management’s best

estimate of the amounts which are probable of being received from SmithKline Beecham to satisfy the indemnified

claims on an after-tax basis. The estimated reserves and related amounts due from SmithKline Beecham are subject to

change as additional information regarding the outstanding claims is gathered and evaluated.

At December 31, 2000 recorded reserves, relating primarily to billing claims including those indemnified by

Corning and SmithKline Beecham, approximated $88 million, including $2 million in other long-term liabilities.

Although management believes that established reserves for both indemnified and non-indemnified claims are sufficient,

it is possible that additional information (such as the indication by the government of criminal activity, additional tests

being questioned or other changes in the government's or private claimants’ theories of wrongdoing) may become

available which may cause the final resolution of these matters to exceed established reserves by an amount which could

be material to the Company's results of operations and cash flows in the period in which such claims are settled. The

Company does not believe that these issues will have a material adverse effect on its overall financial condition.

18. SUBSEQUENT EVENTS

On February 1, 2001, the Company acquired the assets of Clinical Laboratories of Colorado, LLC for $47

million which included $4 million under non-competition agreements. In connection with the transaction, Quest

Diagnostics also entered into a laboratory services agreement with Centura Health, under which it will manage five rapid

turnaround laboratories in the Denver metropolitan area.

On February 21, 2001, the Board of Directors approved a two-for-one stock split of the Company’s common

stock, subject to stockholder approval of an increase in the number of common shares authorized from 100 million shares

to 300 million shares. The stock split will be effected by the issuance on May 31, 2001, of a stock dividend of one new

share of common stock for each share of common stock held by stockholders of record on May 16, 2001. All references

to the number of common shares and per common share amounts, including earnings per common share calculations,

have not been restated to reflect this proposed stock dividend, since the stock dividend is contingent upon stockholder

approval.

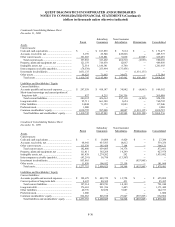

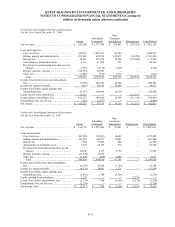

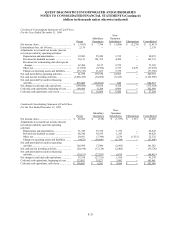

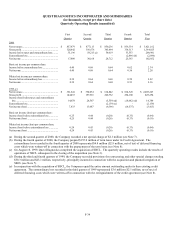

19. SUMMARIZED FINANCIAL INFORMATION

The Notes described in Note 12 are guaranteed, fully, jointly and severally, and unconditionally, on a senior

subordinated basis by substantially all of the Company’s wholly-owned, domestic subsidiaries (“Subsidiary Guarantors”).

With the exception of Quest Diagnostics Receivables Incorporated (see paragraphs below), the non-guarantor

subsidiaries are foreign and less than wholly-owned subsidiaries.

In conjunction with the Receivables Financing described in Note 12, the Company formed a new wholly-owned

non-guarantor subsidiary, Quest Diagnostics Receivables Incorporated (“QDRI”). The Company and the Subsidiary

Guarantors transferred all private domestic receivables (principally excluding receivables due from Medicare, Medicaid

and other Federal programs and receivables due from customers of its joint ventures) to QDRI. QDRI utilized the

transferred receivables to collateralize the Receivables Financing obtained through Blue Ridge Asset Funding

Corporation.

The Company and the Subsidiary Guarantors provide collection services to QDRI. QDRI uses cash collections

principally to purchase new receivables from the Company and the Subsidiary Guarantors.