Quest Diagnostics 2000 Annual Report Download - page 79

Download and view the complete annual report

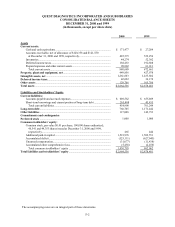

Please find page 79 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-9

Intangible Assets

The cost of acquired businesses in excess of the fair value of net assets acquired is recorded as goodwill and

amortized on the straight-line method over periods not exceeding forty years. Other intangible assets are recorded at cost

and amortized on the straight-line method over periods not exceeding fifteen years.

Impairment of Long-Lived Assets

The Company reviews the recoverability of its long-lived assets, including goodwill and other intangible assets,

when events or changes in circumstances occur that indicate that the carrying value of the asset may not be recoverable.

Evaluation of possible impairment is based on the Company's ability to recover the asset from the expected future pretax

cash flows (undiscounted and without interest charges) of the related operations. If the expected undiscounted pretax

cash flows are less than the carrying amount of such asset, including any goodwill associated with the asset, an

impairment loss is recognized for the difference between the estimated fair value and carrying amount of the asset.

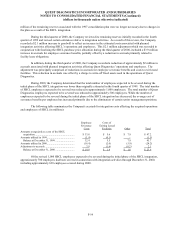

The Company also evaluates the recoverability and measures the possible impairment of goodwill under

Accounting Principles Board Opinion No. 17, “Intangible Assets” based on a fair value methodology. Management

believes that a valuation of goodwill based on the amount for which each regional laboratory could be sold in an arm's-

length transaction is preferable to using projected undiscounted pretax cash flows. The Company believes fair value is a

better indicator of the extent to which goodwill may be recoverable and, therefore, may be impaired.

The fair value method is applied to each of the regional laboratories. Management's estimate of fair value is

primarily based on multiples of forecasted revenue or multiples of forecasted earnings before interest, taxes, depreciation

and amortization (“EBITDA”). The multiples are primarily determined based upon publicly available information

regarding comparable publicly-traded companies in the industry, but also consider (i) the financial projections of each

regional laboratory, (ii) the future prospects of each regional laboratory, including its growth opportunities, managed care

concentration and likely operational improvements, and (iii) comparable sales prices, if available. Multiples of revenues

are used to estimate fair value in cases where the Company believes that the likely acquirer of a regional laboratory

would be a strategic buyer within the industry which would realize synergies from such an acquisition. In regions where

management does not believe there is a potential strategic buyer within the industry, and, accordingly, believes the likely

buyer would not have synergy opportunities, multiples of EBITDA are used for estimating fair value. Regional

laboratories with lower levels of profitability valued using revenue multiples would generally be ascribed a higher value

than if multiples of EBITDA were used, due to assumed synergy opportunities. Management's estimate of fair value is

currently based on multiples of revenue primarily ranging from 0.8 to 1.1 times revenue and on multiples of EBITDA

primarily ranging from 7 to 9 times EBITDA. While management believes the estimation methods are reasonable and

reflective of common valuation practices, there can be no assurance that a sale to a buyer for the estimated value ascribed

to a regional laboratory could be completed. Changes to the method of valuing regional laboratories will be made only

when there is a significant and fundamental change in facts and circumstances, such as significant changes in market

position or the entrance or exit of a significant competitor from a regional market. No changes were made to the method

of valuing regional laboratories in 2000 or 1999.

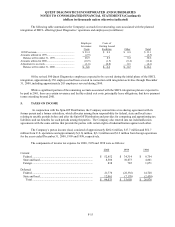

On a quarterly basis, management performs a review of each regional laboratory to determine if events or

changes in circumstances have occurred which could have a material adverse effect on the fair value of the business and

its intangible assets. If such events or changes in circumstances were deemed to have occurred, management would

consult with one or more of its advisors in estimating the impact on fair value of the regional laboratory. Should the

estimated fair value of a regional laboratory be less than the net book value for such laboratory at the end of a quarter, the

Company will record a charge to operations to recognize an impairment of its intangible assets for such difference.

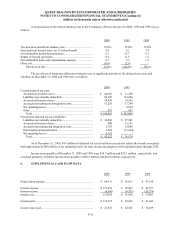

Investments

The Company accounts for investments in equity securities, which are included in other assets, in conformity

with Statement of Financial Accounting Standards No. 115, “Accounting for Certain Investments in Debt and Equity

Securities” (“SFAS 115”), which requires the use of fair value accounting for trading or available-for-sale securities.

Unrealized gains and losses for available-for-sale securities are recorded as a component of accumulated other

comprehensive income (loss) within stockholders’ equity. Gains and losses on securities sold are based on the average

cost method. Other, net for the year ended December 31, 1999 included a fourth quarter gain of $3.0 million associated