Quest Diagnostics 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

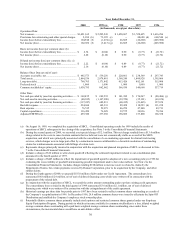

Historical Results of Operations

Year Ended December 31, 2000 Compared with Year Ended December 31, 1999

Income before an extraordinary loss for the year ended December 31, 2000 increased to $104.9 million from a

loss of $1.3 million for the prior year. Extraordinary losses, net of taxes, of $2.9 million and $2.1 million were recorded

in 2000 and 1999, respectively, representing the write-off of deferred financing costs associated with the prepayment of

debt. Additionally, a number of special items were recorded in 2000 and 1999 which consisted of the provisions for

restructuring and other special charges reflected on the face of the statement of operations of $2.1 million and $73.4

million, respectively, and a $3.0 million gain related to the sale of an investment in the fourth quarter of 1999. Excluding

the special items and the extraordinary loss, net income for the year ended December 31, 2000 increased to $106.2

million, compared to $41.2 million for the prior year period. This increase was primarily due to the SBCL acquisition

and improved operating performance of the Company.

Results for the years ended December 31, 2000 and 1999 included the effects of testing performed by third

parties under our laboratory network management arrangements. As laboratory network manager, we included in our

consolidated revenues and expenses the cost of testing performed by third parties. This treatment added $48.8 million

and $91.6 million to both reported revenues and cost of services for the years ended December 31, 2000 and 1999,

respectively. This treatment also serves to increase cost of services as a percentage of net revenues and decrease selling,

general and administrative expenses as a percentage of net revenues. During the first quarter of 2000, we terminated a

laboratory network management arrangement with Aetna USHealthcare, and entered into a new non-exclusive contract

under which we are no longer responsible for the cost of testing performed by third parties. In addition, during the third

quarter of 2000, we amended our laboratory network management contract with Oxford Health to remove the financial

risk associated with testing performed by third parties. As such, we are no longer responsible for the cost of testing

performed by third parties under the contract with Oxford Health. On a full year basis, these changes to the laboratory

network management agreements will reduce net revenues and cost of services by approximately $150 million.

Net Revenues

Net revenues for the year ended December 31, 2000 increased $1.2 billion over the prior year period, primarily

due to the acquisition of SBCL. Also contributing to the increase were improvements in average revenue per requisition

and requisition volume.

Operating Costs and Expenses

Total operating costs for the year ended December 31, 2000 increased from the prior year period, primarily due

to the acquisition of SBCL. Operating costs and expenses for the year ended December 31, 2000 included $8.9 million of

costs related to the integration of SBCL which were not chargeable against previously established reserves for integration

costs. These costs are primarily related to equipment and employee relocation costs, professional and consulting fees,

company identification and signage costs and the amortization of stock-based employee compensation related to the

special recognition awards granted in the fourth quarter of 1999. Management anticipates that during 2001, the Company

will incur similar costs of approximately $2 million to $4 million relative to the integration plan, which will be expensed

as incurred.

The following discussion and analysis regarding operating costs and expenses exclude the effect of testing

performed by third parties under our laboratory network management arrangements, which serve to increase cost of

services as a percentage of net revenues and reduce selling, general and administrative expenses as a percentage of net

revenues.

Cost of services, which includes the costs of obtaining, transporting and testing specimens, decreased during

2000, as a percentage of net revenues, to 59.5% from 61.0% in the prior year period. This decrease was primarily due to

an improvement in average revenue per requisition and the realization of synergies associated with the integration of

SBCL. These decreases were partially offset by an increase in employee compensation and training costs.

Selling, general and administrative expenses, which includes the costs of the sales force, billing operations, bad

debt expense, general management and administrative support, decreased during 2000, as a percentage of net revenues, to

29.7% from 30.4% in the prior year period. This decrease was primarily attributable to improvements in average revenue

per requisition and the impact of the SBCL acquisition which enabled us to leverage certain of our fixed costs across a

larger revenue base, partially offset by increases in employee compensation and training costs, investments related to our