Quest Diagnostics 2000 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-22

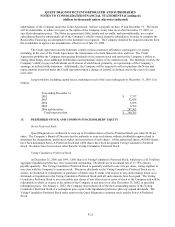

Preferred Share Purchase Rights

Each share of Quest Diagnostics common stock trades with a preferred share purchase right, which entitles

stockholders to purchase one-hundredth of a share of Series A Preferred Stock upon the occurrence of certain events. In

conjunction with the SBCL acquisition, the Board of Directors of the Company approved an amendment to the preferred

share purchase rights. The amended rights entitle stockholders to purchase shares of Series A Preferred Stock at a

predefined price in the event a person or group (other than SmithKline Beecham) acquires 20% or more of the

Company’s outstanding common stock. The preferred share purchase rights expire December 31, 2006.

Common Stock Purchase Program

In 1998, the Board of Directors authorized a limited share purchase program which permitted the Company to

purchase up to $27 million of its outstanding common stock through 1999. Cumulative purchases under the program

through December 31, 1999 totaled $14.1 million. Shares purchased under the program were reissued in connection with

certain employee benefit plans. The Company suspended purchases of its shares when it reached a preliminary

understanding of the transaction with SmithKline Beecham on January 15, 1999.

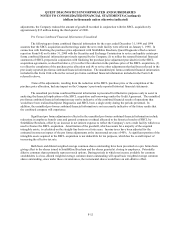

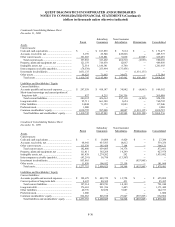

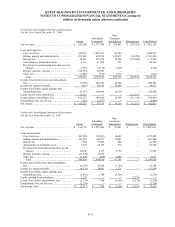

Accumulated Other Comprehensive Income (Loss)

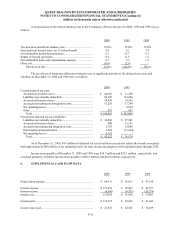

The components of accumulated other comprehensive income (loss) for 2000, 1999 and 1998 were as follows:

Foreign

Currency

Translation

Adjustment

Market Value

Adjustment

Accumulated

Other

Comprehensive

Income (Loss)

Balance, December 31, 1997 .................................. $ (1,170) $ (1,345) $ (2,515)

Translation adjustment ............................................ (924) - (924)

Market value adjustment, net of tax expense of $262 ...... - 401 401

Balance, December 31, 1998 .................................. (2,094) (944) (3,038)

Translation adjustment ............................................ (356) - (356)

Market value adjustment, net of tax expense of $616 ...... - 944 944

Balance, December 31, 1999 .................................. (2,450) - (2,450)

Translation adjustment ............................................ (758) - (758)

Market value adjustment, net of tax benefit of $1,469..... - (2,250) (2,250)

Balance, December 31, 2000 .................................. $ (3,208) $ (2,250) $ (5,458)

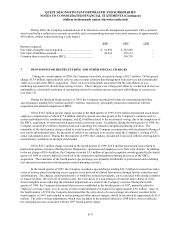

The market valuation adjustment for 1999 included holding gains, net of taxes, of $2.8 million, offset by a

reclassification adjustment, net of taxes, of $1.8 million related to the gain recognized in net income associated with the

sale of an investment during the fourth quarter of 1999. The market value adjustment for 2000 represented unrealized

holding losses, net of taxes, of $2.3 million.

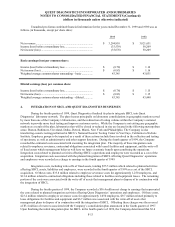

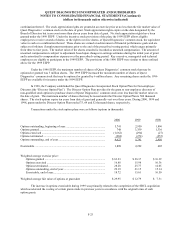

14. STOCK OWNERSHIP AND COMPENSATION PLANS

Employee and Non-employee Directors Stock Ownership Programs

In conjunction with the acquisition of SBCL, the Company established the 1999 Employee Equity Participation

Program (the “1999 EEPP”) to replace the Company’s prior plan established in 1996 (the “1996 EEPP”). The 1999

EEPP provides for three types of awards: (a) stock options, (b) stock appreciation rights and (c) incentive stock awards.

The 1999 EEPP provides for the grant to eligible employees of either non-qualified or incentive stock options, or both, to

purchase shares of Quest Diagnostics’ common stock at no less than the fair market value on the date of grant. The stock

options are subject to forfeiture if employment terminates prior to the end of the prescribed vesting period, as determined

by the Board of Directors. The stock options expire on the date designated by the Board of Directors but in no event more

than eleven years from date of grant. Grants of stock appreciation rights allow eligible employees to receive a payment

based on the appreciation of Quest Diagnostics’ common stock in cash, shares of Quest Diagnostics’ common stock or a