Quest Diagnostics 2000 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-25

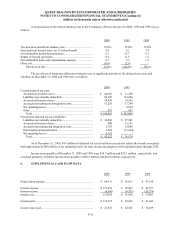

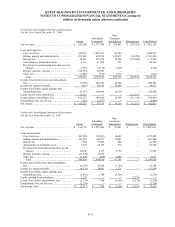

Stock-Based Compensation

Quest Diagnostics has adopted the disclosure-only provisions of SFAS 123, but follows APB 25 and related

interpretations to account for its stock-based compensation plans. Stock-based compensation expense recorded in

accordance with APB 25 was $24.6 million, $26.5 million, and $2.1 million in 2000, 1999 and 1998, respectively. As

discussed in Note 7, for the year ended December 31, 1999, the provisions for restructuring and other special charges

included approximately $20 million of stock-based compensation expense.

If the Company had elected to recognize compensation cost based on the fair value at the grant dates for awards

under its stock-based compensation plans, consistent with the method prescribed by SFAS 123, the Company’s net

income (loss) would have been $81.6 million, $(11.5) million, and $21.4 million for 2000, 1999 and 1998, respectively.

Basic net income (loss) per common share would have been $1.82 per common share, $(0.33) per common share, and

$0.72 per common share for 2000, 1999 and 1998, respectively. Diluted net income (loss) per common share would have

been $1.73 per common share, $(0.33) per common share, and $0.71 per common share for 2000, 1999 and 1998,

respectively.

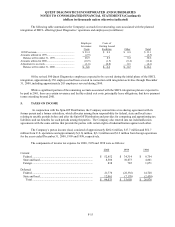

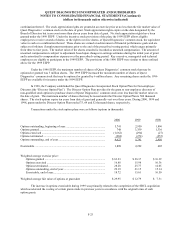

The fair value of each option grant was estimated on the date of grant using the Black-Scholes option-pricing

model with the following weighted average assumptions:

2000 1999 1998

Dividend yield............................ 0.0% 0.0% 0.0%

Risk-free interest rate................. 6.5% 5.8% 5.3%

Expected volatility ..................... 43.7% 46.8% 42.0%

Expected holding period, in

years.................................... 5 5 5

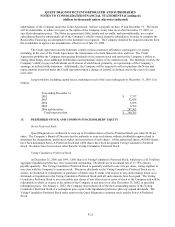

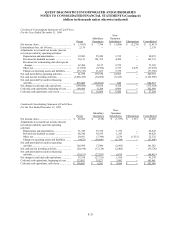

15. EMPLOYEE RETIREMENT PLANS

Defined Contribution Plan

The Company maintains a defined contribution plan covering substantially all of its employees. The Company’s

expense for its contributions to this plan aggregated $29.0 million, $18.3 million, and $15.5 million for 2000, 1999 and

1998, respectively.

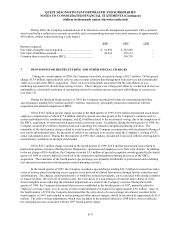

16. RELATED PARTY TRANSACTIONS

As part of the SBCL acquisition agreements, SmithKline Beecham and Quest Diagnostics entered into the

following agreements: a long term contract under which Quest Diagnostics is the primary provider of testing to support

SmithKline Beecham’s clinical trials testing requirements worldwide (the “Clinical Trials Agreement”); data access

agreements under which Quest Diagnostics granted SmithKline Beecham and certain affiliated companies certain non-

exclusive rights and access to use Quest Diagnostics’ proprietary clinical laboratory information database (the “Data

Access Agreements”); and an agreement under which SmithKline Beecham agreed to provide, through December 31,

2000, various administrative services that it had previously provided to SBCL prior to its acquisition by Quest

Diagnostics (the “Transitional Services Agreement”).