Quest Diagnostics 2000 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-20

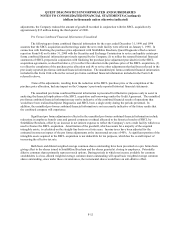

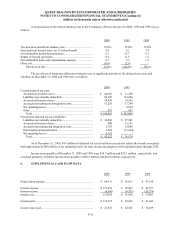

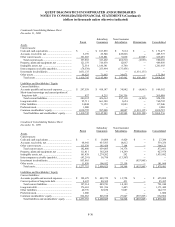

Long-term debt at December 31, 2000 and 1999 consisted of the following:

2000 1999

Senior secured variable rate bank term loans:

Term loan, payable through June 2005; 8.6% interest as of

December 31, 1999.................................................................... $ - $ 362,600

Term loan, payable through June 2006; 9.8% and 9.4% interest

as of December 31, 2000 and 1999, respectively...................... 304,288 319,425

Term loan, payable through June 2006; 10.1% and 9.8%

interest as of December 31, 2000 and 1999, respectively......... 281,304 295,300

Capital markets term loan, due August 2001; 9.2% interest as of

December 31, 1999.................................................................... - 47,674

10¾% senior subordinated notes due 2006 ...................................... 150,000 150,000

Other .................................................................................................. 34,521 41,878

Total ............................................................................................... 770,113 1,216,877

Less current portion........................................................................... 9,408 45,435

Total long-term debt ...................................................................... $ 760,705 $ 1,171,442

At the closing of the SBCL acquisition on August 16, 1999, the Company entered into a new senior secured

credit facility (the “Credit Agreement”). The Credit Agreement included the following facilities: a $250 million six-year

revolving credit facility; a $400 million amortizing term loan payable through June 2005; a $325 million term loan with

minimal amortization until maturity in June 2006; a $300 million term loan with minimal amortization until maturity in

June 2006; and a $50 million two-year capital markets term loan due August 2001, which does not amortize (collectively

the “Term Loans”). As discussed above, the proceeds from the Receivables Financing was used to completely repay

amounts outstanding under the capital markets loan, with the remainder primarily used to repay amounts outstanding

under the term loans. Up to $75 million of the revolving credit facility may be used for letters of credit. Other than the

reduction for outstanding letters of credit, which approximated $13 million, all of the revolving credit facility was

available for borrowing at December 31, 2000.

Interest is based on certain published rates plus an applicable margin that will vary depending on the financial

performance of the Company. The applicable margin was reduced by 25 basis points upon the repayment of the capital

markets term loan in the third quarter of 2000. At the option of the Company, the Company may elect to enter into Libor

based interest rate contracts for periods up to 180 days. Interest on any outstanding principal amount of the Term Loans

not covered under Libor based interest rate contracts is based on the alternate base rate which is calculated by reference to

the prime rate or federal funds rate (as those terms are defined in the Credit Agreement). Prior to the repayment of the

capital markets term loan, a commitment fee of 0.50% was payable on the unused portion of the revolving credit facility;

thereafter, the fee will range from 0.375% to 0.50% based on the financial performance of the Company. The Credit

Agreement requires the Company to mitigate the risk of changes in interest rates associated with its variable interest rate

indebtedness through the use of interest rate swap agreements. Under such arrangements, the Company converts a

portion of its variable rate indebtedness to fixed rates based on a notional principal amount. The settlement dates are

correlated to correspond to the interest payment dates of the hedged debt. During the term of the Credit Agreement, the

notional amounts under the interest rate swap agreements, plus the principal amount outstanding of the Company’s fixed

interest rate indebtedness, must be at least 50% of the Company’s net funded debt (as defined in the Credit Agreement).

As of December 31, 2000 and 1999, the aggregate notional principal amount under interest rate swap agreements, at a

fixed interest rate of 6.2% and 6.1%, respectively, totaled approximately $410 million and $450 million, respectively.

The interest rate swap agreements mature at various dates through November 2002.

The Credit Agreement is collateralized by substantially all tangible and intangible assets of the Company and

by a guaranty from, and a pledge of all capital stock and tangible and intangible assets of, all of the Company’s present

and future wholly-owned domestic subsidiaries. The borrowings under the Credit Agreement rank senior in priority of

repayment to any subordinated indebtedness.

On December 16, 1996, the Company issued $150.0 million of 10¾% senior subordinated notes due 2006 (the

“Notes”). The Notes are general unsecured obligations of the Company and are subordinated in right of payment to all

existing and future senior debt (as defined in the indenture relating to the Notes (the “Indenture”)), including all