Quest Diagnostics 2000 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-23

combination thereof. The stock appreciation rights are granted at an exercise price at no less than the fair market value of

Quest Diagnostics’ common stock on the date of grant. Stock appreciation rights expire on the date designated by the

Board of Directors but in no event more than eleven years from date of grant. No stock appreciation rights have been

granted under the 1999 EEPP. Under the incentive stock provisions of the plan, the 1999 EEPP allows eligible

employees to receive awards of shares, or the right to receive shares, of Quest Diagnostics’ common stock, the equivalent

value in cash or a combination thereof. These shares are earned on achievement of financial performance goals and are

subject to forfeiture if employment terminates prior to the end of the prescribed vesting period, which ranges primarily

from three to four years. The market value of the shares awarded is recorded as unearned compensation. The amount of

unearned compensation is subject to adjustment based upon changes in earnings estimates during the initial year of grant

and is amortized to compensation expense over the prescribed vesting period. Key executive, managerial and technical

employees are eligible to participate in the 1999 EEPP. The provisions of the 1996 EEPP were similar to those outlined

above for the 1999 EEPP.

Under the 1996 EEPP, the maximum number of shares of Quest Diagnostics’ common stock that may be

optioned or granted was 3 million shares. The 1999 EEPP increased the maximum number of shares of Quest

Diagnostics’ common stock that may be optioned or granted by 6 million shares. Any remaining shares under the 1996

EEPP are available for issuance under the 1999 EEPP.

In 1998, the Company established the Quest Diagnostics Incorporated Stock Option Plan for Non-employee

Directors (the “Director Option Plan”). The Director Option Plan provides for the grant to non-employee directors of

non-qualified stock options to purchase shares of Quest Diagnostics’ common stock at no less than fair market value on

the date of grant. The maximum number of shares that may be issued under the Director Option Plan is 500 thousand

shares. The stock options expire ten years from date of grant and generally vest over three years. During 2000, 1999 and

1998, grants under the Director Option Plan totaled 75, 69 and 52 thousand shares, respectively.

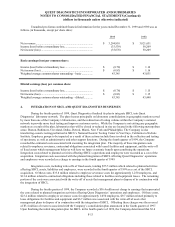

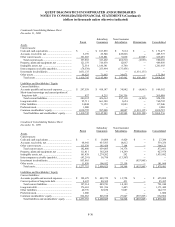

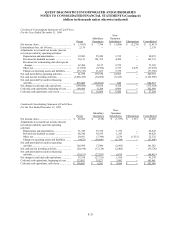

Transactions under the stock option plans were as follows (options in thousands):

2000 1999 1998

Options outstanding, beginning of year....................................................... 5,741 2,950 1,896

Options granted............................................................................................ 748 3,359 1,336

Options exercised ........................................................................................ (1,662) (294) (27)

Options terminated ...................................................................................... (204) (274) (255)

Options outstanding, end of year ................................................................. 4,623 5,741 2,950

Exercisable .................................................................................................. 1,809 2,222 405

Weighted average exercise price:

Options granted .................................................................................... $ 63.23 $ 26.37 $ 16.39

Options exercised ................................................................................. 16.88 15.98 16.36

Options terminated ............................................................................... 28.20 25.77 14.65

Options outstanding, end of year.......................................................... 29.19 21.15 15.14

Exercisable, end of year........................................................................ 18.72 15.61 16.50

Weighted average fair value of options at grant date $ 29.95 $ 12.79 $ 7.31

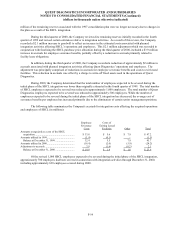

The increase in options exercisable during 1999 was primarily related to the completion of the SBCL acquisition

which accelerated the vesting of certain grants made in previous years in accordance with the original terms of such

option grants.