Quest Diagnostics 2000 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-19

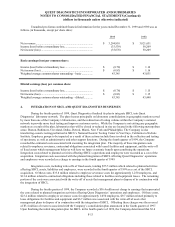

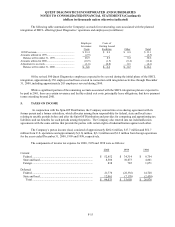

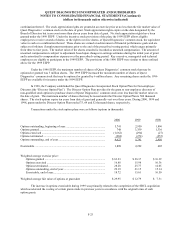

10. INTANGIBLE ASSETS

Intangible assets at December 31, 2000 and 1999 consisted of the following:

2000 1999

Goodwill ......................................................................................... $ 1,387,242 $ 1,517,527

Customer lists ................................................................................. 39,480 38,556

Other (principally non-compete agreements) ................................ 39,347 39,346

1,466,069 1,595,429

Less: accumulated amortization..................................................... (204,466) (159,547)

Total ........................................................................................ $ 1,261,603 $ 1,435,882

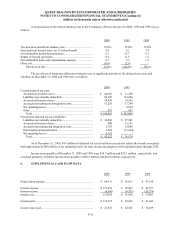

11. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at December 31, 2000 and 1999 consisted of the following:

2000 1999

Accrued expenses ........................................................................... $ 199,528 $ 288,603

Accrued wages and benefits........................................................... 240,275 189,945

Accrued settlement reserves........................................................... 86,076 49,473

Accrued restructuring and integration costs .................................. 33,012 45,023

Income taxes payable ..................................................................... 18,450 29,324

Trade accounts payable .................................................................. 112,241 53,441

Total ........................................................................................ $ 689,582 $ 655,809

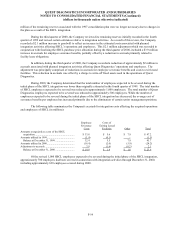

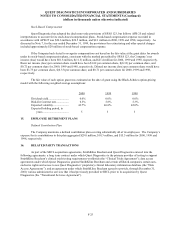

12. DEBT

Short-term borrowings and current portion of long-term debt at December 31, 2000 and 1999 consisted of the

following:

2000 1999

Short-term borrowings under receivables financing ..................... $ 256,000 $ -

Current portion of long-term debt.................................................. 9,408 45,435

Total ........................................................................................ $ 265,408 $ 45,435

On July 21, 2000, the Company completed a $256 million receivables-backed financing transaction (the

“Receivables Financing”), the proceeds of which were used to pay down loans outstanding under the Credit Agreement.

Approximately $48 million was used to completely repay amounts outstanding under the capital markets loan, with the

remainder used to repay amounts outstanding under the term loans. In addition, the repayment of the capital markets loan

reduced the borrowing spreads on all remaining term loans under the Credit Agreement. The Receivables Financing

facility was provided on an uncommitted basis by Blue Ridge Asset Funding Corporation, a commercial paper funding

vehicle administered by Wachovia Bank, N.A. and with a one year back-up facility provided on a committed basis by

Wachovia Bank, N.A. The Receivables Financing has an initial term of three years, unless extended, or terminated early

as a result of the termination of liquidity commitments to Blue Ridge Asset Funding Corporation. The borrowings

outstanding under the Receivables Financing are classified as a current liability since the lenders fund the borrowings

through the issuance of commercial paper which matures at various dates up to ninety days from the date of issuance.

Interest is based on rates which approximate commercial paper rates for highly rated issuers. The weighted average

interest rate on borrowings outstanding at December 31, 2000 was 7.2%.