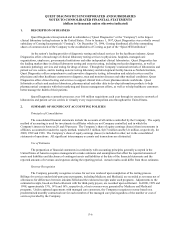

Quest Diagnostics 2000 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

factors that contributed to the increase in average revenue per requisition included modifications to various managed care

contracts, an increase in higher value testing, and a shift to greater fee-for-service reimbursement.

Operating Costs and Expenses

Total operating costs for the year ended December 31, 2000 increased from the prior year period, principally as

a result of increased volume and increased employee compensation and training costs. Operating costs and expenses for

the year ended December 31, 2000 included $8.9 million of costs related to the integration of SBCL which were not

chargeable against previously established reserves for integration costs.

The following discussion and analysis regarding operating costs and expenses exclude the effect of testing

performed by third parties under our laboratory network management arrangements, and the revenues and expenses

associated with a customer contract treated as a loss contract, beginning in the third quarter of 1999. As discussed above,

losses associated with this contract amounted to $7.1 million for the year ended December 31, 1999. In addition,

operating costs and expenses for the year ended December 31, 1999 included $39.5 million of discrete expense items,

recorded in SBCL’s historical financial statements prior to the closing of the SBCL acquisition.

Cost of services for the year ended December 31, 2000 decreased to 59.5% from 62.3% for the prior year period.

For the year ended December 31, 1999, cost of services included $7.8 million of discrete expense items. Excluding

discrete expense items, cost of services as a percentage of net revenues was 62.1%. Excluding the impact of the discrete

expense items, the decrease in cost of services, as a percentage of net revenues, was primarily due to improvements in

average revenue per requisition and to a lesser extent, the impact of the SBCL integration to date on the Company’s cost

structure. These decreases in cost of services were partially offset by an increase in employee compensation and training

costs.

Selling, general and administrative expenses, as a percentage of net revenues, were 29.7% in 2000, compared to

30.5% in the prior year period. Excluding the impact of discrete expense items of $31.7 million in 1999, selling, general

and administrative expenses, as a percentage of net revenues, were 29.5%. Excluding the impact of the discrete expense

items in 1999, the increase in selling, general and administrative expenses, as a percentage of net revenues, was primarily

attributable to increases in employee compensation and training costs and investments related to the Company’s

information technology strategy. These increases were in large part offset by improvements in average revenue per

requisition and bad debt expense. As discussed above, for the year ended December 31, 1999, bad debt expense included

discrete expense items of $22.4 million which represented bad debt charges, reflecting the reduced recoverability of

SBCL receivables, as a result of the special review of the SBCL financial statements. Bad debt expense for 2000

improved to 7.0% of net revenues, compared to 7.6%, excluding the impact of the discrete expense items in 1999. This

progress was primarily due to process improvements in the SBCL billing functions, with particular focus in the areas of

obtaining missing information and reducing billing backlogs. We have made significant progress towards improving the

overall bad debt experience of the combined company with quarter to quarter improvements in bad debt expense

throughout 2000. Based on prior experience as well as the sharing of internal best practices in the billing functions, we

believe that substantial opportunities continue to exist to improve our overall collection experience.

Interest, Net

Excluding $1.9 million of interest income associated with a favorable state tax settlement in 1999, net interest

expense for the year ended December 31, 2000 decreased by $11.5 million compared to the prior year period. This

reduction was primarily due to an overall reduction in debt levels as well as the favorable impact of the Receivables

Financing which has served to lower the weighted average borrowing rate on our outstanding debt.

Provisions for Restructuring and Other Special Charges

During the second quarter of 2000, we recorded a net special charge of $2.1 million. Of the special charge,

$13.4 million represented the costs to cancel certain contracts that we believed were not economically viable as a result of

the SBCL acquisition. These costs were principally associated with the cancellation of a co-marketing agreement for

clinical trials testing services. These charges were in large part offset by a reduction in reserves attributable to a

favorable resolution of outstanding claims for reimbursements associated with billings of certain tests.

During the second, third and fourth quarters of 1999, we recorded provisions for restructuring and other special

charges totaling $15.8 million, $30.3 million and $43.1 million, respectively, principally incurred in connection with the

acquisition and planned integration of SBCL.