Quest Diagnostics 2000 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

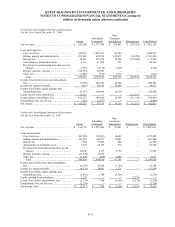

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-21

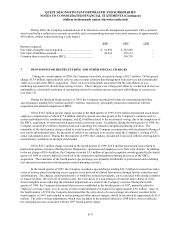

indebtedness of the Company under the Credit Agreement. Interest is payable on June 15 and December 15. The Notes

will be redeemable, in whole or in part, at the option of the Company at any time on or after December 15, 2001, at

specified redemption prices. The Notes are guaranteed, fully, jointly and severally, and unconditionally, on a senior

subordinated basis by substantially all of the Company’s wholly-owned, domestic subsidiaries. In order to complete the

Receivables Financing, an amendment to the Indenture was required. The Company obtained the required consents from

the noteholders to approve the amendments, effective as of July 21, 2000.

The Credit Agreement and the Indenture contain various customary affirmative and negative covenants,

including, in the case of the Credit Agreement, the maintenance of certain financial ratios and tests. The Credit

Agreement prohibits the Company from paying dividends on its common stock and restricts the Company’s ability to,

among other things, incur additional indebtedness and repurchase shares of its common stock. The Indenture restricts the

Company’s ability to pay cash dividends on all classes of stock based, primarily, on a percentage of the Company’s

earnings, as defined in the Indenture. Additionally, the Company will be required to offer to purchase the Notes and

repay amounts borrowed under the Credit Agreement upon a change of control, as defined, and in the event of certain

asset sales.

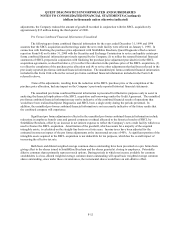

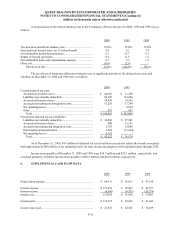

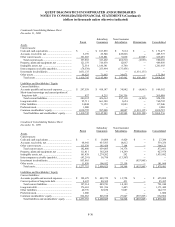

Long-term debt, including capital leases, maturing in each of the years subsequent to December 31, 2001 is as

follows:

Year ending December 31,

2002 $ 7,337

2003 32,434

2004 6,666

2005 6,706

2006 and thereafter 707,562

Total long-term debt $ 760,705

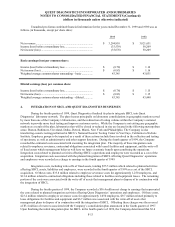

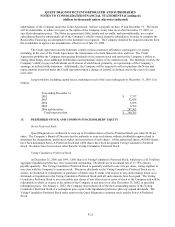

13. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00 per

share. The Company’s Board of Directors has the authority to issue such shares without stockholder approval and to

determine the designations, preferences, rights, and restrictions of such shares. Of the authorized shares, 600,000 shares

have been designated Series A Preferred Stock and 1,000 shares have been designated Voting Cumulative Preferred

Stock. No shares have been issued, other than the Voting Cumulative Preferred Stock.

Voting Cumulative Preferred Stock

At December 31, 2000 and 1999, 1,000 shares of Voting Cumulative Preferred Stock, which have a $1.0 million

aggregate liquidation preference, were issued and outstanding. Dividends are at an annual rate of 11.75% and are

payable quarterly. The Voting Cumulative Preferred Stock is generally entitled to one vote per share, voting together as

one class with the Company’s common stock. Whenever dividends on the Voting Cumulative Preferred Stock are in

arrears, no dividends or redemptions or purchases of shares may be made with respect to any stock ranking junior as to

dividends or liquidation to the Voting Cumulative Preferred Stock until all such amounts have been paid. The Voting

Cumulative Preferred Stock is not convertible into shares of any other class or series of stock of the Company and will be

redeemable in whole or in part, at the option of the Company at any time on or after December 31, 2002, at specified

redemption prices. On January 1, 2022, the Company must redeem all of the then outstanding shares of the Voting

Cumulative Preferred Stock at a redemption price equal to the liquidation preference plus any unpaid dividends. The

Voting Cumulative Preferred Stock ranks senior to the Quest Diagnostics common stock and the Series A Preferred

Stock.