Quest Diagnostics 2000 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-13

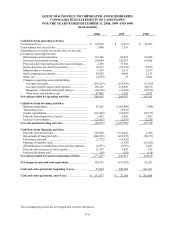

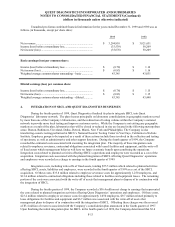

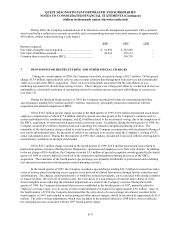

Unaudited pro forma combined financial information for the years ended December 31, 1999 and 1998 was as

follows (in thousands, except per share data):

1999 1998

Net revenues ................................................................................... $ 3,294,810 $ 3,021,631

Income (loss) before extraordinary loss......................................... (33,539) 50,209

Net income (loss)............................................................................ (35,678) 50,209

Basic earnings (loss) per common share:

Income (loss) before extraordinary loss......................................... $ (0.78) $ 1.16

Net income (loss)............................................................................ $ (0.83) $ 1.16

Weighted average common shares outstanding – basic ................ 43,345 43,031

Diluted earnings (loss) per common share:

Income (loss) before extraordinary loss......................................... $ (0.78) $ 1.15

Net income (loss)............................................................................ $ (0.83) $ 1.15

Weighted average common shares outstanding – diluted ............. 43,345 43,440

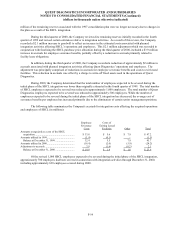

4. INTEGRATION OF SBCL AND QUEST DIAGNOSTICS BUSINESSES

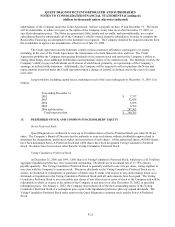

During the fourth quarter of 1999, Quest Diagnostics finalized its plan to integrate SBCL into Quest

Diagnostics’ laboratory network. The plan focuses principally on laboratory consolidations in geographic markets served

by more than one of the Company’s laboratories, and the redirection of testing volume within the Company’s national

network to provide more local testing and improve customer service. While the Company is not exiting any geographic

markets as a result of the plan, laboratories that will be closed or reduced in size are located in the following metropolitan

areas: Boston, Baltimore, Cleveland, Dallas, Detroit, Miami, New York and Philadelphia. The Company is also

transferring esoteric testing performed at SBCL’s National Esoteric Testing Center in Van Nuys, California to Nichols

Institute. Employee groups to be impacted as a result of these actions include those involved in the collection and testing

of specimens, as well as administrative and other support functions. During the fourth quarter of 1999, the Company

recorded the estimated costs associated with executing the integration plan. The majority of these integration costs

related to employee severance, contractual obligations associated with leased facilities and equipment, and the write-off

of fixed assets which management believes will have no future economic benefit upon combining the operations.

Integration costs related to planned activities affecting SBCL’s operations and employees were recorded as a cost of the

acquisition. Integration costs associated with the planned integration of SBCL affecting Quest Diagnostics’ operations

and employees were recorded as a charge to earnings in the fourth quarter of 1999.

Integration costs, including write-offs of fixed assets, totaling $55.5 million which related to planned activities

affecting SBCL assets, liabilities and employees, were recorded in the fourth quarter of 1999 as a cost of the SBCL

acquisition. Of these costs, $33.8 million related to employee severance costs for approximately 1,250 employees, and

$13.4 million related to contractual obligations including those related to facilities and equipment leases. The remaining

portion of the costs were associated with the write-off of assets that management plans to dispose of in conjunction with

the integration of SBCL.

During the fourth quarter of 1999, the Company recorded a $36.4 million net charge to earnings that represented

the costs related to planned integration activities affecting Quest Diagnostics’ operations and employees. Of these costs,

$23.4 million related to employee severance costs for approximately 1,050 employees, $9.7 million related primarily to

lease obligations for facilities and equipment and $6.7 million was associated with the write-off of assets that

management plans to dispose of in conjunction with the integration of SBCL. Offsetting these charges was the reversal

of $3.4 million of reserves associated with the Company’s consolidation plan announced in the fourth quarter of 1997.

Upon finalizing the initial integration plan for SBCL in the fourth quarter of 1999, the Company determined that $3.4