Quest Diagnostics 2000 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-11

annual and interim financial statements. The Company currently operates in one reportable business segment.

Substantially all of the Company’s services are provided within the United States, and substantially all of the Company's

assets are located within the United States. No one customer accounted for ten percent or more of net sales in 2000, 1999

or 1998.

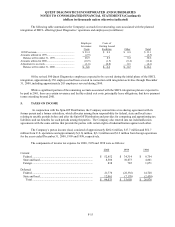

3. ACQUISITION OF SMITHKLINE BEECHAM’S CLINICAL LABORATORY TESTING BUSINESS

On August 16, 1999, the Company completed the acquisition of SmithKline Beecham Clinical Laboratories, Inc.

(“SBCL”) which operated the clinical laboratory business of SmithKline Beecham plc (“SmithKline Beecham”). The

original purchase price of approximately $1.3 billion was paid through the issuance of 12,564,336 shares of common

stock of the Company (valued at $260.7 million), representing approximately 29% of the Company's then outstanding

common stock, and the payment of $1.025 billion in cash, including $20 million under a non-competition agreement

between the Company and SmithKline Beecham. At the closing of the acquisition, the Company used existing cash and

borrowings under a new senior secured credit facility (the “Credit Agreement”) to fund the cash purchase price and

related transaction costs of the acquisition, and to repay the entire amount outstanding under its then existing credit

agreement. The acquisition of SBCL was accounted for under the purchase method of accounting. The historical

financial statements of Quest Diagnostics include the results of operations of SBCL subsequent to the closing of the

acquisition.

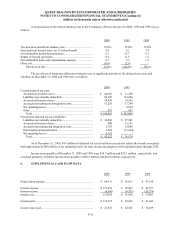

Under the terms of the acquisition agreements, Quest Diagnostics acquired SmithKline Beecham’s clinical

laboratory testing business including its domestic and foreign clinical testing operations, clinical trials testing, corporate

health services, and laboratory information products businesses. SmithKline Beecham’s national testing and service

network consisted of regional laboratories, specialty testing operations and its National Esoteric Testing Center, as well

as a number of rapid-turnaround or “stat” laboratories, and patient service centers. In addition, SmithKline Beecham and

Quest Diagnostics entered into a long-term contract under which Quest Diagnostics is the primary provider of testing to

support SmithKline Beecham’s clinical trials testing requirements worldwide. As part of the acquisition agreements,

Quest Diagnostics granted SmithKline Beecham certain non-exclusive rights and access to use Quest Diagnostics’

proprietary clinical laboratory information database. Under the acquisition agreements, SmithKline Beecham has agreed

to indemnify Quest Diagnostics, on an after tax basis, against certain matters primarily related to taxes and billing and

professional liability claims.

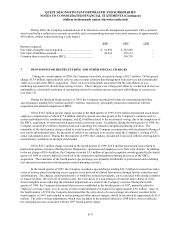

Under the terms of a stockholder agreement, SmithKline Beecham has the right to designate two nominees to

Quest Diagnostics’ Board of Directors as long as SmithKline Beecham owns at least 20% of the outstanding common

stock. As long as SmithKline Beecham owns at least 10% but less than 20% of the outstanding common stock, it will

have the right to designate one nominee. Quest Diagnostics’ Board of Directors was expanded to nine directors

following the closing of the acquisition. The stockholder agreement also imposes limitations on the right of SmithKline

Beecham to sell or vote its shares and prohibits SmithKline Beecham from purchasing in excess of 29.5% of the

outstanding common stock of Quest Diagnostics.

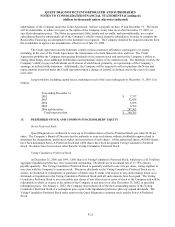

As of December 31, 2000 and 1999, the Company had recorded approximately $820 million and $950 million,

respectively, of goodwill in conjunction with the SBCL acquisition, representing acquisition cost in excess of the fair

value of net tangible assets acquired, which is amortized on the straight-line basis over forty years. The amount paid

under the non-compete agreement is amortized on the straight-line basis over five years.

The SBCL acquisition agreements included a provision for a reduction in the purchase price paid by Quest

Diagnostics in the event that the combined balance sheet of SBCL indicated that the net assets acquired, as of the

acquisition date, were below a prescribed level. On October 11, 2000, the purchase price adjustment was finalized with

the result that SmithKline Beecham owed Quest Diagnostics $98.6 million. This amount was offset by $3.6 million

separately owed by Quest Diagnostics to SmithKline Beecham, resulting in a net payment by SmithKline Beecham of

$95.0 million. The purchase price adjustment was recorded in the Company’s financial statements in the fourth quarter

of 2000 as a reduction in the amount of goodwill recorded in conjunction with the SBCL acquisition.

The remaining components of the purchase price allocation relating to the SBCL acquisition were finalized

during the third quarter of 2000. The resulting adjustments to the SBCL purchase price allocation primarily related to an

increase in deferred tax assets acquired, the sale of certain assets of SBCL at fair value to unconsolidated joint ventures of

Quest Diagnostics and an increase in accrued liabilities for costs related to pre-acquisition periods. As a result of these