Quest Diagnostics 2000 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-18

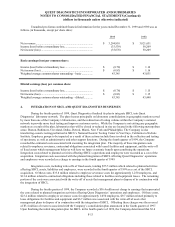

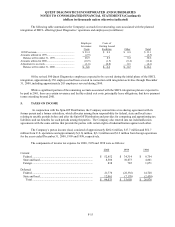

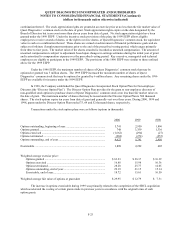

The following table summarizes the Company's accruals associated with prior restructuring plans (in millions):

Employee

Severance

Costs

Costs of

Exiting Leased

Facilities Other Total

Balance, December 31,1997 ....................................... $ 18.5 $ 6.6 $ 5.1 $ 30.2

Amounts utilized in 1998.......................................... (13.4) (2.5) (2.8) (18.7)

Balance, December 31, 1998 ................................ 5.1 4.1 2.3 11.5

Amounts utilized in 1999.......................................... (4.6) (2.1) (0.1) (6.8)

Reversal........................................................................ (0.1) (1.3) (2.0) (3.4)

Balance, December 31, 1999 ................................ $ 0.4 $ 0.7 $ 0.2 $ 1.3

As discussed in Note 4, upon finalizing the initial integration plan for SBCL in the fourth quarter of 1999, the

Company determined that $3.4 million of the remaining reserves associated with the 1997 consolidation plan were no

longer necessary, due to changes in the plan as a result of the SBCL integration.

No material accruals, related to prior restructuring plans, existed at December 31, 2000.

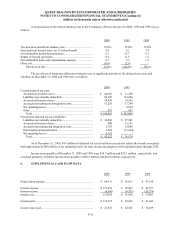

8. EXTRAORDINARY LOSS

Extraordinary losses were recorded in 2000 and 1999 representing the write-off of deferred financing costs

associated with debt which was prepaid during the periods.

During the fourth quarter of 2000, the Company prepaid $155 million of term loans under its Credit Agreement.

The extraordinary loss recorded in the fourth quarter of 2000 in connection with this prepayment was $4.8 million ($2.9

million, net of taxes).

In conjunction with the acquisition of SBCL, the Company repaid the entire amount outstanding under its then

existing credit agreement. The extraordinary loss recorded in the third quarter of 1999 in connection with this prepayment

was $3.6 million ($2.1 million, net of taxes).

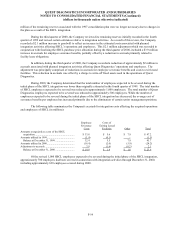

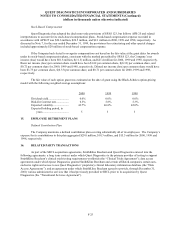

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment at December 31, 2000 and 1999 consisted of the following:

2000 1999

Land ................................................................................................ $ 35,084 $ 35,928

Buildings and improvements.......................................................... 258,433 263,232

Laboratory equipment, furniture and fixtures................................ 386,204 376,175

Leasehold improvements ............................................................... 60,187 59,774

Computer software developed or obtained for internal use ........ 38,567 26,500

Construction-in-progress................................................................ 55,078 33,836

833,553 795,445

Less: accumulated depreciation and amortization......................... (383,697) (367,467)

Total ........................................................................................ $ 449,856 $ 427,978