Quest Diagnostics 2000 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

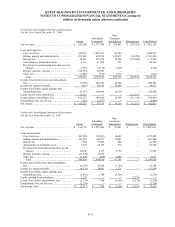

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-26

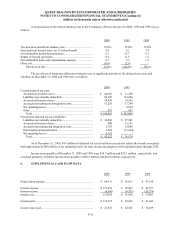

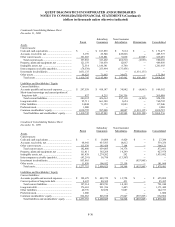

Significant transactions with SmithKline Beecham during 2000 and 1999 included (in addition to the acquisition

of SBCL during 1999):

2000 1999

Clinical trials testing revenues............................................ $ 31,334 $ 10,261

Revenues under Data Access Agreements ......................... 650 -

Purchases, primarily related to services rendered by

SmithKline Beecham under the Transitional Services

Agreement........................................................................ 15,901 4,577

In addition, under the SBCL acquisition agreements, SmithKline Beecham has agreed to indemnify Quest

Diagnostics, on an after tax basis, against certain matters primarily related to taxes and billing and professional liability

claims (see Note 17).

At December 31, 2000 and 1999, net amounts due from SmithKline Beecham totaled $58.6 million and $46.0

million, respectively; $44.5 million and $18.0 million, respectively, was classified in prepaid expenses and other current

assets at December 31, 2000 and 1999; and $14.1 million and $28.0 million, respectively, was classified in other assets at

December 31, 2000 and 1999.

At December 31, 2000 and 1999, the amount due from Corning, classified in prepaid expenses and other current

assets, was $8.1 million and $14.0 million, respectively. The receivable from Corning was decreased in 2000, 1999 and

1998 by $5.9 million, $2.0 million, and $0.7 million, respectively, through an adjustment to additional paid-in capital,

based on management's best estimate of amounts which are probable of being received from Corning to satisfy the

remaining indemnified government claims. In January 2001, the Company received $8.1 million from Corning related to

certain indemnified government claims settled in December 2000 (see Note 17).

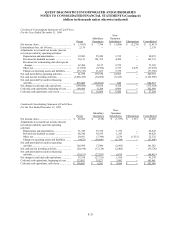

17. COMMITMENTS AND CONTINGENCIES

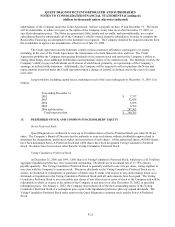

Minimum rental commitments under noncancelable operating leases, primarily real estate, in effect at

December 31, 2000 are as follows:

Year ending December 31,

2001..................................................................................................... $ 70,821

2002..................................................................................................... 56,742

2003..................................................................................................... 42,902

2004..................................................................................................... 30,103

2005..................................................................................................... 23,745

2006 and thereafter.............................................................................. 58,672

Minimum lease payments ................................................................... 282,985

Noncancelable sub-lease income........................................................ (36,254)

Net minimum lease payments............................................................. $ 246,731

Operating lease rental expense for 2000, 1999 and 1998 aggregated $76.5 million, $59.1 million, and $46.3

million, respectively.

The Company is substantially self-insured for all casualty losses and maintains excess coverage primarily on a

claims made basis. The basis for insurance reserves at December 31, 2000 and 1999 is the actuarially determined

projected losses for each program (limited by its self-insured retention) based upon the Company's loss experience.

The Company has entered into several settlement agreements with various governmental and private payers

during recent years relating to industry-wide billing and marketing practices that had been substantially discontinued by

early 1993. In addition, the Company is aware of several pending lawsuits filed under the qui tam provisions of the civil