Quest Diagnostics 2000 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

statement of operations, respectively, a $9.7 million gain recognized by SBCL on the sale of its physician office-based

teleprinter assets and network in the first quarter of 1999 and a $3.0 million gain related to the sale of an investment in

the fourth quarter of 1999. Excluding the special items and the extraordinary loss, net income for the year ended

December 31, 2000 increased to $106.2 million, compared to $12.6 million for the prior year period.

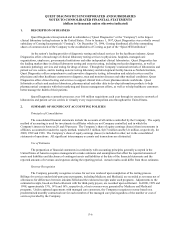

A special review of the SBCL pre-closing financial statements, called for in the SBCL acquisition agreements,

was conducted to assess the recoverability of assets and the adequacy of liabilities existing prior to the closing date of the

acquisition. This special review resulted in adjustments, primarily related to the recoverability of SBCL receivables and

accrued liabilities during various periods prior to the closing of the SBCL acquisition. In addition, SBCL recorded

certain other income and expense items prior to the closing of the SBCL acquisition. The adjustments resulting from the

special review and the other income and expense items, recorded by SBCL prior to the closing of the acquisition, served

as a basis for the $98.6 million purchase price adjustment which was discussed earlier. Management believes that the

adjustments resulting from the special review and the other income and expense items, both of which have not been

reflected on the face of the pro forma combined financial information, are of a non-recurring nature and limit the

comparability of results between the periods presented. In the discussions that follow, these matters are collectively

referred to as discrete income and expense items.

Discrete expense items for the year ended December 31, 1999, totaled $46.6 million, including bad debt charges

of $22.4 million to reflect the reduced recoverability of SBCL receivables, as a result of the special review of the SBCL

financial statements; $11.5 million of expenses recorded by SBCL prior to the acquisition, primarily to record liabilities

necessary to properly present the closing balance sheet of SBCL; $7.1 million of losses related to a customer contract

accounted for as a loss contract beginning in the third quarter of 1999; and $5.6 million of costs for which SmithKline

Beecham is obligated to indemnify the Company associated with two incidents, the most significant of which related to a

SBCL employee who allegedly reused certain needles when drawing blood from patients. Excluding the impact of the

discrete expense items, income before an extraordinary loss and special items for the year ended December 31, 1999 was

$40.5 million.

Results for the years ended December 31, 2000 and 1999 included the effects of testing performed by third

parties under our laboratory network management arrangements. As laboratory network manager, we included in our

consolidated revenues and expenses the cost of testing performed by third parties. This treatment added $48.8 million to

both reported revenues and cost of services for the year ended December 31, 2000. For the year ended December 31,

1999, this treatment added $154.0 million to both pro forma revenues and pro forma cost of services. This treatment also

serves to increase cost of services as a percentage of net revenues and decrease selling, general and administrative

expenses as a percentage of net revenues. During the first quarter of 2000, we terminated a laboratory network

management arrangement with Aetna USHealthcare, and entered into a new non-exclusive contract under which we will

no longer be responsible for the cost of testing performed by third parties. In addition, during the third quarter of 2000,

we amended our laboratory network management contract with Oxford Health to remove the financial risk associated

with testing performed by third parties. As such, we will no longer be responsible for the cost of testing performed by

third parties under the contract with Oxford Health. On a full year basis, these changes to the laboratory network

management agreements will reduce net revenues and cost of services by approximately $150 million.

Net Revenues

Net revenues for the year ended December 31, 2000 increased by $126.4 million or 3.8% from the prior year

level. Revenue growth for the year ended December 31, 2000 was partially offset by accounting for a customer contract

as a loss contract beginning in the second half of 1999 and the elimination of the financial risk associated with testing

performed by third parties under the Aetna USHealthcare and Oxford Health managed care contracts modified during the

period, as discussed above. Adjusted for these changes, net revenues for the year ended December 31, 2000 increased by

8.6%, compared to pro forma net revenues in the prior year period. Average revenue per requisition increased by 5.9%,

compared to 1999. On a full year basis, clinical testing volumes grew by approximately 3.0%, after adjusting for the

contribution of business to unconsolidated joint ventures. Reported clinical testing volume growth was 2.5% above the

1999 pro forma level.

Volume in the second half of 2000 grew at a slower rate than earlier in the year, principally due to the intensified

pace of integration activities, the contribution of certain business to unconsolidated joint ventures and the loss of certain

contracts due to aggressive pricing on the part of competitors. In addition, testing volumes were impacted by severe

weather in certain service areas during the fourth quarter of 2000. Management believes the Company is well positioned,

particularly upon completion of integration activities, to benefit from improving industry fundamentals as well as its

ability to leverage its value proposition of offering expanded patient access, broad testing capabilities and superior

quality. While our long-standing pricing discipline continued to favorably impact average revenue per requisition, other