Quest Diagnostics 2000 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-17

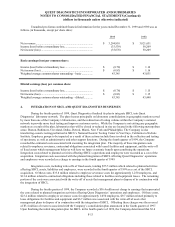

During 2000, the Company terminated one of its laboratory network management agreements with a customer

which resulted in a reduction in accounts receivable and a corresponding decrease in accrued expenses of approximately

$69 million, neither reduction having a cash impact.

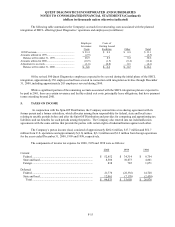

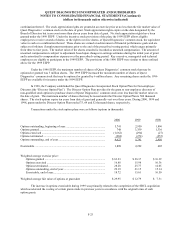

2000 1999 1998

Business acquired:

Fair value of tangible assets acquired ............................................ $ 61,894 $ 702,489 -

Fair value of liabilities assumed..................................................... 26,212 378,113 -

Common shares issued to acquire SBCL....................................... - 260,710 -

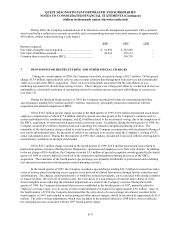

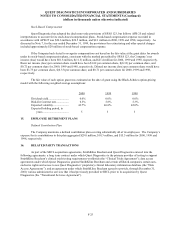

7. PROVISIONS FOR RESTRUCTURING AND OTHER SPECIAL CHARGES

During the second quarter of 2000, the Company recorded a net special charge of $2.1 million. Of the special

charge, $13.4 million represented the costs to cancel certain contracts that management believed were not economically

viable as a result of the SBCL acquisition. These costs were principally associated with the cancellation of a co-

marketing agreement for clinical trials testing services. These charges were in large part offset by a reduction in reserves

attributable to a favorable resolution of outstanding claims for reimbursements associated with billings of certain tests

(see Note 17).

During the third and fourth quarters of 1999, the Company recorded provisions for restructuring and other

special charges totaling $30.3 million and $43.1 million, respectively, principally incurred in connection with the

acquisition and planned integration of SBCL.

Of the $30.3 million special charge recorded in the third quarter of 1999, $19.8 million represented stock-based

employee compensation of which $17.8 million related to special one-time grants of the Company’s common stock to

certain individuals of the combined company, and $2.0 million related to the accelerated vesting, due to the completion of

the SBCL acquisition, of restricted stock grants made in previous years. In addition, during the third quarter of 1999, the

Company incurred $9.2 million of professional and consulting fees related to integration planning activities. The

remainder of the third quarter charge related to costs incurred by the Company in conjunction with its planned offering of

new senior subordinated notes, the proceeds of which were expected to be used to repay the Company’s existing 10¾%

senior subordinated notes. During the third quarter of 1999, the Company decided not to proceed with the offering due to

unsatisfactory conditions in the high yield market.

Of the $43.1 million charge recorded in the fourth quarter of 1999, $36.4 million represented costs related to

planned integration activities affecting Quest Diagnostics’ operations and employees (see Note 4 for details). In addition

to the net charge of $36.4 million, the Company recorded $3.5 million of special recognition awards granted in the fourth

quarter of 1999 to certain employees involved in the transaction and integration planning processes of the SBCL

acquisition. The remainder of the fourth quarter special charge was primarily attributable to professional and consulting

fees incurred in connection with integration related planning activities.

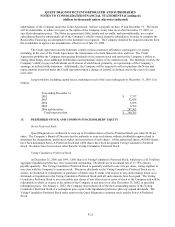

In the fourth quarter of 1997, the Company recorded a special charge totaling $48.7 million in connection with a

series of actions aimed at reducing excess capacity in its network of clinical laboratories through facility reductions and

consolidations. The charges consisted primarily of workforce reduction programs, costs associated with exiting a number

of leased facilities, the write-off of certain assets, the write-down of a non-strategic investment and a charge to write-

down intangible assets reflecting the estimated impairment as a result of the Company’s actions. During the fourth

quarter of 1998, the Company determined that reserves established in the fourth quarter of 1997, primarily related to

employee severance costs, were in excess of what would ultimately be required by approximately $3.0 million. Also, in

the fourth quarter of 1998, the Company determined that the write-down of a non-strategic investment, recorded in the

fourth quarter of 1997 and included in restructuring and other special charges, should be increased by approximately $3.0

million. The effect of these adjustments, which were included in the amounts utilized in 1998 below, was to reallocate

the remaining reserves associated with the 1997 fourth quarter charge.