Quest Diagnostics 2000 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(dollars in thousands unless otherwise indicated)

F-12

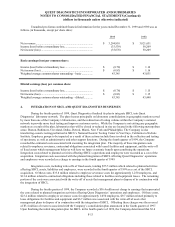

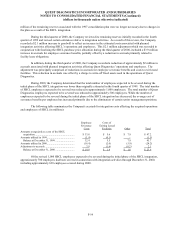

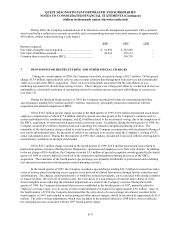

adjustments, the Company reduced the amount of goodwill recorded in conjunction with the SBCL acquisition by

approximately $35 million during the third quarter of 2000.

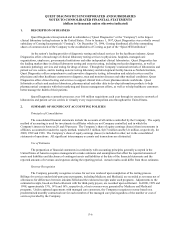

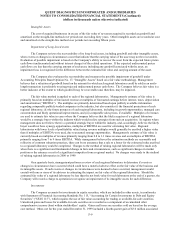

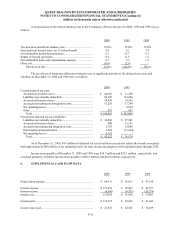

Pro Forma Combined Financial Information (Unaudited)

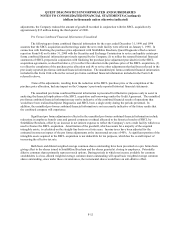

The following pro forma combined financial information for the years ended December 31, 1999 and 1998

assumes that the SBCL acquisition and borrowings under the new credit facility were effected on January 1, 1998. In

connection with finalizing the purchase price adjustment with SmithKline Beecham, Quest Diagnostics filed a current

report on Form 8-K on October 31, 2000 with the Securities and Exchange Commission to revise and update certain pro

forma combined financial information previously reported by the Company (1) to reflect the restated historical financial

statements of SBCL prepared in conjunction with finalizing the purchase price adjustment provided for in the SBCL

acquisition agreements, as described above, (2) to reflect the reduction in the purchase price of the SBCL acquisition, (3)

to reflect the completion of the purchase price allocation and (4) to revise other adjustments that had been reflected in the

previously reported pro forma combined financial information. The unaudited pro forma combined financial information

included in this Form 10-K reflects the revised pro forma combined financial information included in the Form 8-K

referred to above.

None of the adjustments, resulting from the reduction in the SBCL purchase price or the completion of the

purchase price allocation, had any impact on the Company’s previously reported historical financial statements.

The unaudited pro forma combined financial information is presented for illustrative purposes only to assist in

analyzing the financial implications of the SBCL acquisition and borrowings under the Credit Agreement. The unaudited

pro forma combined financial information may not be indicative of the combined financial results of operations that

would have been realized had Quest Diagnostics and SBCL been a single entity during the periods presented. In

addition, the unaudited pro forma combined financial information is not necessarily indicative of the future results that

the combined company will experience.

Significant pro forma adjustments reflected in the unaudited pro forma combined financial information include

reductions in employee benefit costs and general corporate overhead allocated to the historical results of SBCL by

SmithKline Beecham, offset by an increase in net interest expense to reflect the Company’s new credit facility which was

used to finance the SBCL acquisition. Amortization of the goodwill, which accounts for a majority of the acquired

intangible assets, is calculated on the straight-line basis over forty years. Income taxes have been adjusted for the

estimated income tax impact of the pro forma adjustments at the incremental tax rate of 40%. A significant portion of the

intangible assets acquired in the SBCL acquisition is not deductible for tax purposes, which has the overall impact of

increasing the effective tax rate.

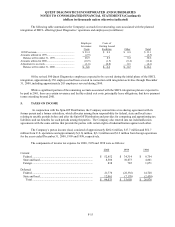

Both basic and diluted weighted average common shares outstanding have been presented on a pro forma basis

giving effect to the shares issued to SmithKline Beecham and the shares granted at closing to employees. Potentially

dilutive common shares primarily represent stock options. During periods in which net income available for common

stockholders is a loss, diluted weighted average common shares outstanding will equal basic weighted average common

shares outstanding, since under these circumstances, the incremental shares would have an anti-dilutive effect.