Quest Diagnostics 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

PART II

Item 5. Market for Registrant’s Common Stock and Related Stockholder Matters

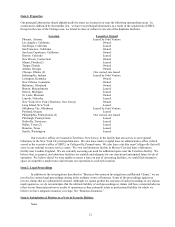

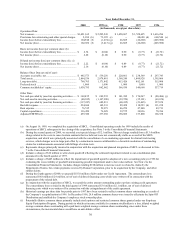

Our common stock is listed and traded on the New York Stock Exchange under the symbol “DGX.” The

following table sets forth, for the periods indicated, the high and low sales price per share as reported on the New York

Stock Exchange Consolidated Tape:

High Low

1998

First Quarter $ 17.13 $ 15.06

Second Quarter 23.06 16.13

Third Quarter 22.00 16.00

Fourth Quarter 18.63 14.50

1999

First Quarter 22.81 17.75

Second Quarter 27.50 21.50

Third Quarter 28.13 23.75

Fourth Quarter 32.94 22.56

2000

First Quarter 40.38 29.13

Second Quarter 74.75 37.00

Third Quarter 141.00 73.25

Fourth Quarter 146.25 82.75

As of February 28, 2001, we had approximately 6,800 record holders of our common stock.

We have not paid dividends in 2000 and 1999, and do not expect to pay dividends on our common stock in the

foreseeable future. Our bank credit facility prohibits us from paying cash dividends on our common stock. The Indenture

relating to our 10¾% senior subordinated notes due 2006 restrict our ability to pay cash dividends based primarily on a

percentage of our earnings, as defined.

Item 6. Selected Financial Data

See page 29.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

See pages 32.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

See Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Item 8. Financial Statements and Supplementary Data

See Item 14 (a) 1 and 2.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.