Quest Diagnostics 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

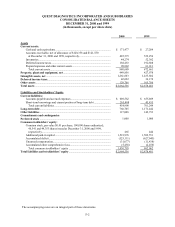

from operating activities for 1999 was $108.2 million higher than the 1998 level. The increase is primarily due to the

impact of the SBCL acquisition.

Improvements in the billing operations subsequent to the acquisition of SBCL have led to an improvement in the

number of days sales outstanding, a measure of billing and collection efficiency. Excluding the impact of our laboratory

network management arrangements, days sales outstanding were 56 days at December 31, 2000, compared to 57 days at

December 31, 1999.

Net cash used in investing activities in 2000 was primarily comprised of capital expenditures and investments in

two companies, one company which is developing Internet-based disease management solutions for physicians and

managed care organizations, and another company which is developing Internet-based solutions to provide electronic

medical records products. These investing activities in 2000 were partially offset by the receipt of $95 million from

SmithKline Beecham in conjunction with finalizing the purchase price adjustment provided for in the SBCL acquisition

agreements. Investing activities for 1999 were principally related to the acquisition of SBCL, including transaction costs

associated with the acquisition. In addition, net cash used in investing activities for 1999 included capital expenditures,

investments to fund certain employee benefit plans, and contributions to our joint venture in Arizona, offset by the

proceeds from the sale of an investment in the fourth quarter of 1999.

Net cash used in financing activities for 2000 was principally associated with the repayment of debt under our

Credit Agreement and distributions to minority partners, partially offset by proceeds from the completion of a $256

million receivables-backed financing transaction (the “Receivables Financing”) and proceeds from the exercise of stock

options. On July 21, 2000, we completed the Receivables Financing, the proceeds of which were used to pay down loans

outstanding under the Credit Agreement. Approximately $48 million was used to completely repay amounts outstanding

under the capital markets loan, with the remainder used to repay amounts outstanding under the term loans. In addition,

the repayment of the capital markets loan reduced the borrowing spreads on all remaining term loans under the Credit

Agreement. Management estimates that this transaction will result in a reduction in annual borrowing costs of

approximately $5 million to $7 million. The borrowings outstanding under the Receivables Financing are classified as a

current liability since the lenders fund the borrowings through the issuance of commercial paper which matures at various

dates up to ninety days from the date of issuance. During the fourth quarter of 2000, we prepaid $155 million of bank

debt under the Credit Agreement. Net cash provided by financing activities for 1999 primarily consisted of borrowings

under the Credit Agreement to fund the cash purchase price and related transaction costs of the SBCL acquisition,

repayments of debt, the majority of which related to our then existing credit agreement at the closing of the SBCL

acquisition, and payments of financing costs associated with our new Credit Agreement.

In 1998, the Board of Directors authorized a limited share purchase program which permitted the Company to

purchase up to $27 million of its outstanding common stock through 1999. Cumulative purchases under the program

through December 31, 1999 totaled $14.1 million. Shares purchased under the program were reissued in connection with

certain employee benefit plans. We suspended purchases of our shares when we reached a preliminary understanding of

the transaction with SmithKline Beecham on January 15, 1999.

We estimate that we will invest approximately $130 million to $150 million during 2001 for capital expenditures

to support and expand our existing operations, principally related to investments in information technology, equipment,

and facility upgrades and expansions necessary to accommodate the integration of the SBCL business. Other than the

reduction for outstanding letters of credit, which approximated $13 million at December 31, 2000, all of the revolving

credit facility under the Credit Agreement was available for borrowing at December 31, 2000.

We expect to continue to prepay the term loans outstanding under the Credit Agreement with excess cash on

hand during 2001. In conjunction with these prepayments, a portion of the deferred financing costs associated with the

term loans are expected to be written-off and charged to earnings as extraordinary losses, net of applicable taxes.

We believe that cash from operations and the revolving credit facility under the Credit Agreement, together with

the indemnifications by Corning and SmithKline Beecham against monetary fines, penalties or losses from outstanding

government and other related claims, will provide sufficient financial flexibility to integrate the operations of Quest

Diagnostics and SBCL, to meet seasonal working capital requirements and to fund capital expenditures and additional

growth opportunities for the foreseeable future. Additionally, we believe that our improved financial performance should

provide us with access to additional financing, if necessary, to fund growth opportunities which cannot be funded from

existing sources.