Quest Diagnostics 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

Payers

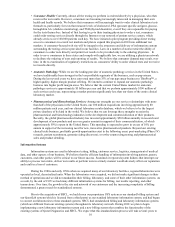

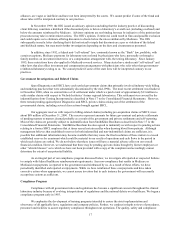

The following table shows current estimates of the breakdown of the percentage of our total volume of

requisitions and total clinical laboratory revenues during 2000 applicable to each payer group:

Requisition Volume

as % of

Total Volume

Revenue

as % of

Total

Clinical Laboratory

Revenues

Patient ................................................... 3% — 5% 5% — 10%

Medicare and Medicaid......................... 10% — 15% 10% — 15%

Physicians, Hospitals, Employers and

Other Monthly-Billed Payers ................ 30% — 35% 25% — 30%

Third Party Fee-for-Service .................. 25% — 30% 40% — 45%

Managed Care-Capitated....................... 20% — 25% 5% — 10%

Customers

Physicians

Physicians requiring testing for patients whose tests are not covered by a managed care contract are one of the

primary sources of our clinical laboratory testing volume. We typically bill physician accounts on a fee-for-service basis.

Fees billed to physicians are based on the laboratory's client fee schedule and are typically negotiated. Fees billed to

patients and third parties are based on the laboratory's patient fee schedule, which may be subject to limitations on fees

imposed by third-party payers and negotiation by physicians on behalf of their patients. Medicare and Medicaid

reimbursements are based on fee schedules set by governmental authorities.

Managed Care Organizations

Managed care organizations, which typically contract with a limited number of clinical laboratories for their

members, represent a substantial portion of our business. Larger managed care organizations typically prefer to use large

independent clinical laboratories because they can provide services on a national or regional basis and can manage

networks of local or regional laboratories. In addition, larger laboratories are better able to achieve the low-cost structures

necessary to profitably service large managed care organizations and can provide test utilization data across their various

plans.

Over the last decade, the number of patients participating in managed care plans had grown significantly. In

addition, the managed care industry has been consolidating, resulting in fewer but larger managed care organizations with

significant bargaining power in negotiating fee arrangements with healthcare providers, including clinical laboratories.

Managed care organizations frequently negotiate capitated payment contracts for a portion of their business, which shift

the risk and cost of testing from the managed care organization to the clinical laboratory. Under a capitated payment

contract, the clinical laboratory and the managed care organization agree to a per member, per month payment to cover

all laboratory tests during the month, regardless of the number or cost of the tests actually performed. Some services,

such as various esoteric tests, new technologies and anatomic pathology services, may be carved out from a capitated rate

and, if carved out, are charged on a fee-for-service basis. Some capitated payment contracts include retroactive or future

fee adjustments if the number of tests performed for the managed care organization exceeds or is less than the negotiated

threshold levels. For their fee-for-service testing, managed care organizations also typically negotiate substantial

discounts.

Capitated agreements with managed care organizations have historically been priced aggressively, particularly

for exclusive or semi-exclusive arrangements. This practice was due to competitive pressures and the expectation that a

laboratory could capture not only the testing covered under the contract, but also additional higher priced fee-for-service

business from participating physicians. However, as the number of patients covered under managed care organizations

increased, more patients were covered by capitated agreements and there was less fee-for-service business, and therefore

less profitable business to offset the lower margin capitated managed care business. Furthermore, physicians became

increasingly affiliated with more than one managed care organization, and, therefore, a clinical laboratory received little,

if any, additional fee-for-service testing from participating physicians.