Quest Diagnostics 2000 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2000 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-34

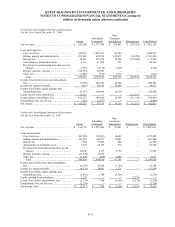

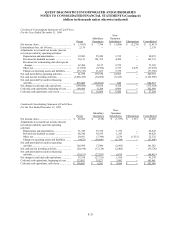

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

(in thousands, except per share data)

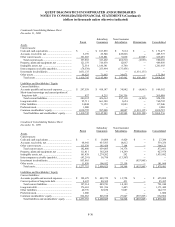

Quarterly Operating Results (unaudited)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Total

Year

2000

Net revenues.......................................................... $ 857,479 $ 877,113 $ 850,236 $ 836,334 $ 3,421,162

Gross profit ........................................................... 328,442 356,676 345,494 334,313 1,364,925

Income before taxes and extraordinary loss......... 35,196 58,213 (a) 54,019 53,553 200,981

Extraordinary loss ................................................. - - - (2,896) (b) (2,896)

Net income ............................................................ 17,809 30,168 28,712 25,363 102,052

Basic net income per common share:

Income before extraordinary loss ......................... 0.40 0.68 0.64 0.62 2.34

Net income............................................................ 0.40 0.68 0.64 0.56 2.28

Diluted net income per common share:

Income before extraordinary loss ......................... 0.39 0.64 0.60 0.59 2.22

Net income............................................................ 0.39 0.64 0.60 0.53 2.16

1999 (c)

Net revenues.......................................................... $ 381,841 $ 394,034 $ 614,842 $ 814,526 $ 2,205,243

Gross profit ........................................................... 144,433 157,963 228,752 294,106 825,254

Income (loss) before taxes and extraordinary

loss .................................................................... 14,078 24,507 (5,559) (d) (18,642) (d) 14,384

Extraordinary loss................................................. - - (2,139) (e) - (2,139)

Net income (loss) .................................................. 7,433 13,087 (9,396) (14,537) (3,413)

Basic net income (loss) per common share:

Income (loss) before extraordinary loss ............... 0.25 0.44 (0.20) (0.33) (0.04)

Net income (loss) .................................................. 0.25 0.44 (0.26) (0.33) (0.10)

Diluted net income (loss) per common share:

Income (loss) before extraordinary loss ............... 0.24 0.43 (0.20) (0.33) (0.04)

Net income (loss) .................................................. 0.24 0.43 (0.26) (0.33) (0.10)

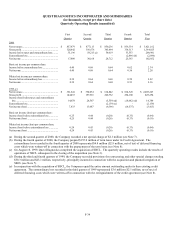

(a) During the second quarter of 2000, the Company recorded a net special charge of $2.1 million (see Note 7).

(b) During the fourth quarter of 2000, the Company prepaid $155.0 million of term loans under its Credit Agreement. The

extraordinary loss recorded in the fourth quarter of 2000 represented $4.8 million ($2.9 million, net of tax) of deferred financing

costs which were written-off in connection with the prepayment of the term loans (see Note 8).

(c) On August 16, 1999, Quest Diagnostics completed the acquisition of SBCL. The quarterly operating results include the results of

operations of SBCL subsequent to the closing of the acquisition (see Note 3).

(d) During the third and fourth quarters of 1999, the Company recorded provisions for restructuring and other special charges totaling

$30.3 million and $43.1 million, respectively, principally incurred in connection with the acquisition and planned integration of

SBCL (see Note 7).

(e) In conjunction with the acquisition of SBCL, the Company repaid the entire amount outstanding under its then existing credit

agreement. The extraordinary loss recorded in the third quarter of 1999 represented $3.6 million ($2.1 million, net of tax) of

deferred financing costs which were written-off in connection with the extinguishment of the credit agreement (see Note 8).